This content is also available in: German

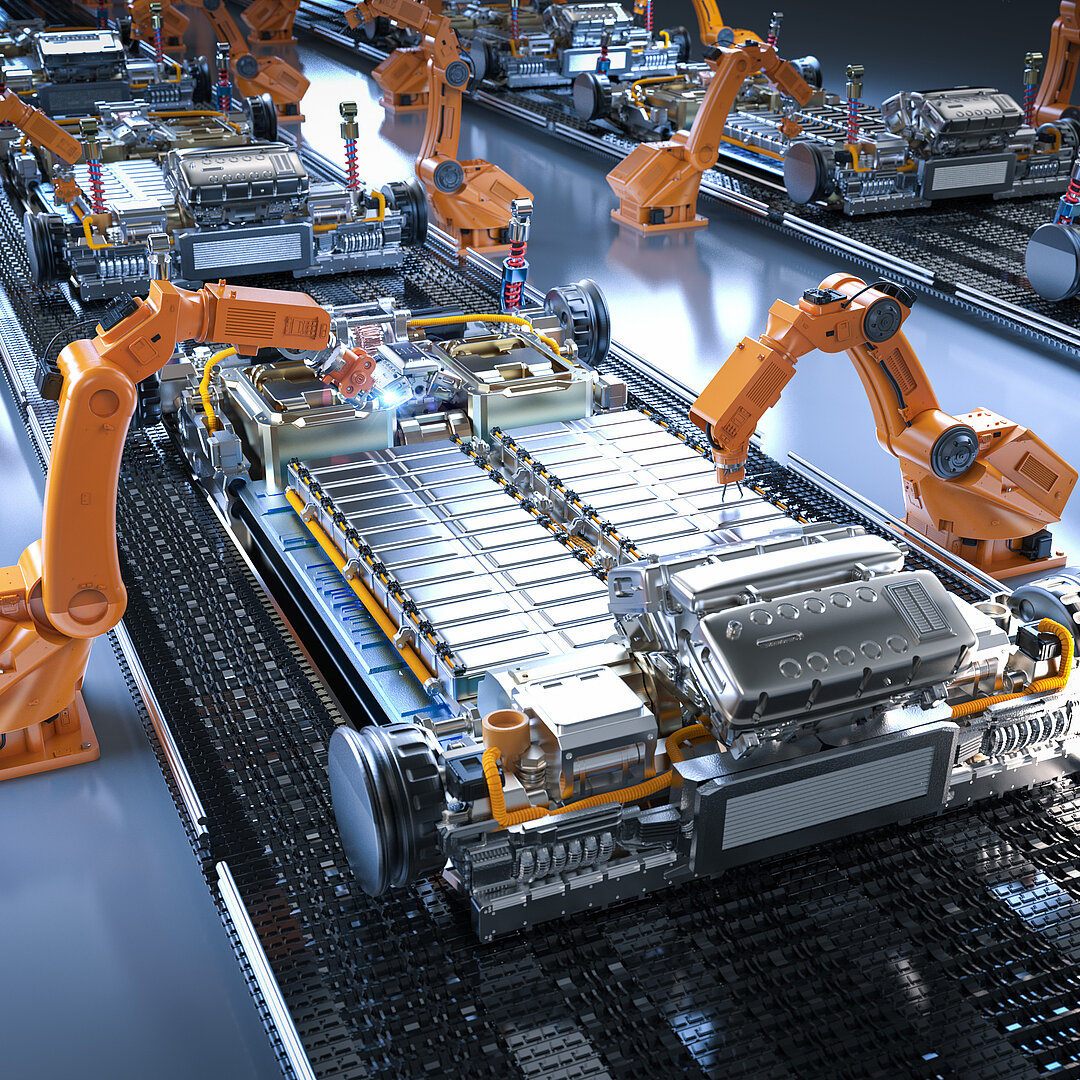

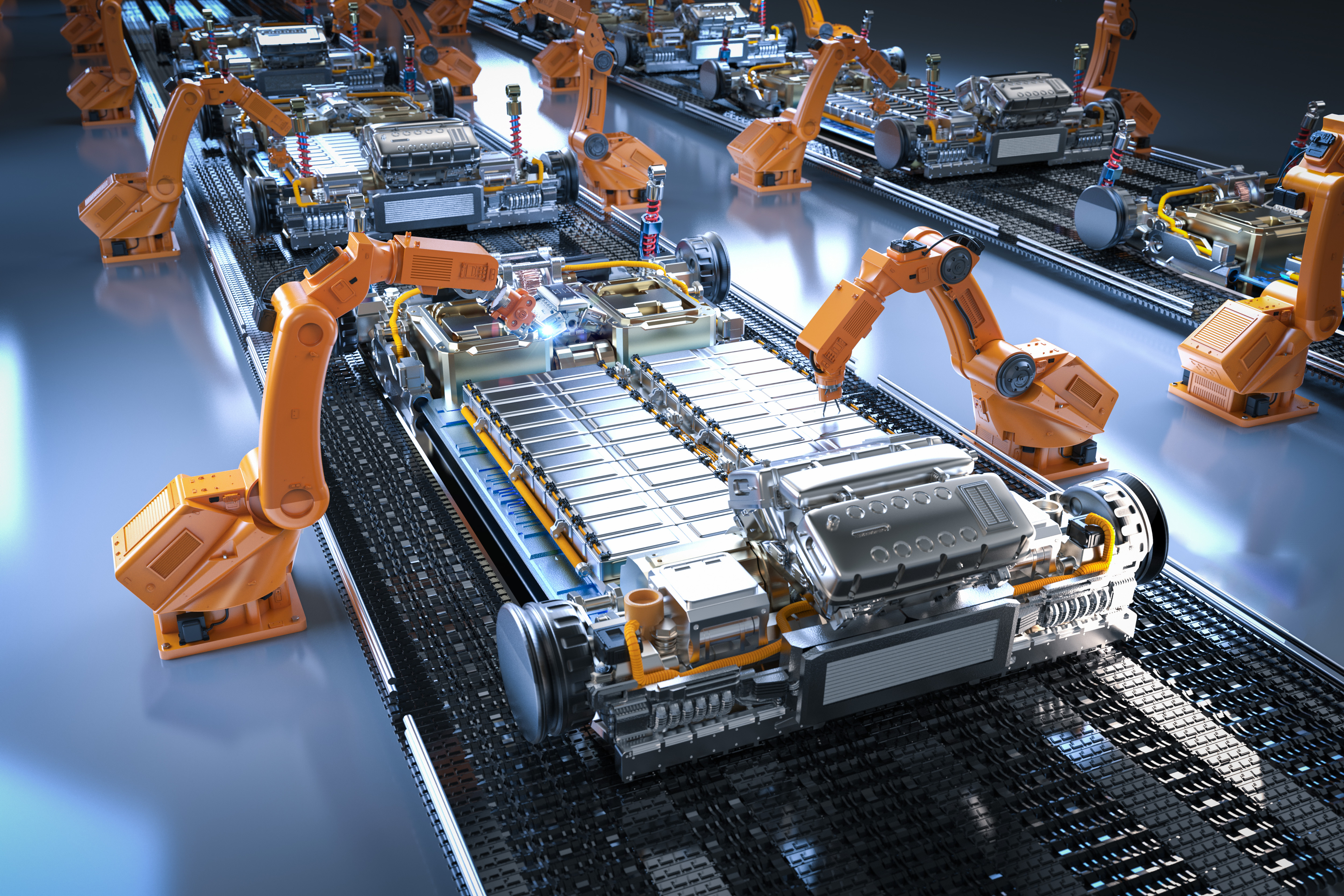

Europe's battery industry: Boosting competitiveness through new partnerships

Agora Verkehrswende analysis provides recommendations for competitive and resilient battery production / Focus on partnerships with raw material-producing countries, establishing value chains and cooperation with Asian cell manufacturers

11 September 2025. The think tank Agora Verkehrswende recommends that the EU and the German government push ahead with the expansion of the battery industry. The aim must be to quickly become more crisis-proof and capable of connecting to the global market leaders in cell production, raw material processing and component manufacturing. This requires a bundle of measures, including strategic partnerships with raw material-producing countries, minimum quotas for battery components manufactured in Europe, and cooperation with Asian technology leaders, for example in the form of joint ventures. In addition, significantly better support for all stages of the vehicle battery value chain, including high-quality battery recycling in Europe, is necessary. Agora Verkehrswende published an analysis on these topics in German in June. This paper is now also available in English.

Christian Hochfeld, director of Agora Verkehrswende, comments: "The automotive industry is undergoing the biggest structural change in its history. Electric mobility will become the dominant form of propulsion in the coming years. This is strongly evident at this year’s IAA Summit in Munich. Battery technology and industry play a key role in the transformation process. If Germany and Europe want to catch up with global markets, industrial policy will have to accelerate the establishment of a competitive battery industry in the EU. This has to be on the agenda of the Strategic Dialogue between the President of the European Commission, Ursula von der Leyen, and the European automotive industry. A strong automotive sector requires a strong domestic battery industry and a fast pace on the way to electric mobility. Every delay in transforming Europe’s automotive industry will weaken its global competitiveness. The future of road traffic is electric. The world will not wait for Germany or Europe."

According to a forecast by the International Energy Agency (IEA), global demand for batteries for electric vehicles will increase to around seven times its current level by 2035 with the political measures already decided upon. Asia already has a considerable lead in battery production, in terms of both technology and volume. According to current figures, China’s battery cell production capacity is around 14 times that of Europe, even though the Chinese market for electric car batteries is only about three times as large in comparison. Although the EU has set itself the goal of becoming a world leader in sustainable battery production, it is currently unable to keep pace with China in many areas of battery manufacturing and technology, according to the Agora Verkehrswende discussion paper.

European response to global race for technology locations needed

To catch up with Asia, the think tank says that an industrial policy strategy is needed at EU level to attract Asian companies to Europe under European rules. Innovations could arise, for example, through joint ventures between Asian technology leaders and German or European partners. It is important that uniform rules apply in the areas of environmental protection and workers' rights.

The German government should support the introduction of minimum quotas for battery components produced in the EU. A policy of attracting the value chains necessary for battery production would make Europe more resilient in the face of complex and unstable global supply chains and create sustainable jobs. In addition to cell production, raw material processing, such as lithium refining, and component manufacturing are particularly necessary in Europe. The EU's localisation plans are a step in the right direction, but so far they have not been backed by substantial funding.

Raw material partnerships and recycling create resilience

The EU will be largely dependent on imports of battery raw materials to build up a battery industry. According to Agora Verkehrswende, this requires strategic partnerships with raw material-rich countries from all parts of the world – also to become less dependent on China. In view of the global race for raw materials, the EU is called upon to offer attractive contracts for mutual benefit.

Particularly in partnerships with countries in the Global South, the aim should also be to promote sustainable economic development and value creation locally. In addition, high-quality battery recycling is needed to reduce the demand for primary raw materials and ensure more stable value chains. Compared to other European countries, Germany is well positioned to expand its recycling industry.

Kerstin Meyer, Senior Associate at Agora Verkehrswende, says: “It is good that the German governing parties have announced in their coalition agreement that they will promote battery cell production, including raw material extraction, recycling, and mechanical and plant engineering. It is important that the federal government now resolutely pushes ahead with this plan and ensures sufficient funding.”

Note to editorial offices

The discussion paper A strong European battery industry for a strong automotive sector is available for free download here.