- Publisher

- Agora Verkehrswende

- Authors

- Leon Berks

- Publication number

- 140-EN-2025

- Version number

- 1.0

- Publication date

-

28 November 2025

- Pages

- 17

- Suggested citation

- Agora Verkehrswende (2025): Africa’s Raw Materials for Electric Mobility at a Glance. How abundant raw materials for electric vehicles in Africa create opportunities for domestic development in partnership with Europe.

Africa’s Raw Materials for Electric Mobility at a Glance

How abundant raw materials for electric vehicles in Africa create opportunities for domestic development in partnership with Europe

- Why this topic matters

- What are raw materials for electric mobility?

- What is the current status of African raw material production for electric mobility?

- Where does Africa stand in the global value chain for raw materials used in electric mobility?

- How can Africa benefit from its raw materials for electric mobility?

- Summary: Advancing the development of African electric mobility clusters that harness domestic raw materials

Why this topic matters

As global markets for electric vehicles (EVs) continue to grow, demand for the resources required for their production has been rising in turn.

Countries across the African continent are already key producers of several essential raw materials. Moreover, Africa holds substantial reserves that will be critical for the rapid expansion of green technologies, including electric vehicles, which are needed on a large scale to meet global decarbonization targets while also supporting economic development and industrial growth.

Given Africa’s rapid development and projected CO₂ emission increases – not least in transport – it is especially important to consider the continent’s role in meeting global net-zero goals. Electric mobility offers the most efficient technical pathway for Africa to reduce dependence on fossil fuels in road transport and achieve a low-carbon transport sector. Home to abundant raw materials, Africa has a unique opportunity to establish integrated clusters for electric mobility that link mining, local processing, battery production, and vehicle assembly.

While there is considerable divergence between African countries, the continent as a whole has yet to fully take advantage of its natural resource wealth for the benefit of its domestic economies. Raw materials are typically exported for processing and further manufacturing elsewhere, limiting the continent’s ability to capture higher-value segments of the supply chain. By developing domestic processing and manufacturing capacities as well as fostering local demand for electric mobility, African nations could retain more value creation domestically. This would not only stimulate economic development but also accelerate broader public access to sustainable transport solutions.

This factsheet provides an overview of the current state of raw material production for electric mobility in Africa, highlights the opportunities offered by these resources, and explores how partnerships with the European Union and its member states can support mutually beneficial, resilient, and sustainable supply chains.

What are raw materials for electric mobility?

EVs have distinct raw material needs: Although EVs require many of the same raw material inputs as internal combustion engine (ICE) vehicles – such as iron ore for steel and bauxite for aluminium – EVs rely more heavily on certain materials while requiring others unique to electric-drive technology.

Lithium-ion batteries (LIB) are the key energy storage component in an EV and their production requires various critical raw materials. In addition to high-purity graphite for anode manufacture, EV batteries generally require lithium, iron, and phosphate (for the production of LFP cathodes) or lithium, nickel, manganese, and cobalt (for the production of NMC cathodes).[1] In Europe, NMC remains the dominant cathode chemistry, whereas in China, cobalt-free LFP cells are now preferred due to technological advancements and associated cost advantages (see Figure 1).[2]

The second EV-specific component is the electric motor. Most passenger EVs use permanent-magnet synchronous motors (PMSMs)[3] that rely on neodymium-iron-boron (NdFeB) magnets containing rare earths such as neodymium, praseodymium, and dysprosium.[4] Lastly, while both ICEs and EVs require copper as an input, copper is needed in much higher quantities for the production of EVs: ICE vehicles can contain around 24 kg of copper, hybrids average 40–60 kg, and full EVs can require 80–91 kg – more than three times as much as ICE vehicles.[5]

Forecasting primary raw material needs is difficult: As part of the global expansion of electric mobility , the demand for these raw materials is growing strongly and is projected to rise even further in coming years.[6] However, specific primary raw material needs will depend on several factors, including not only the market development of different battery cell chemistries and electric motor types, but also the successful implementation of battery recycling systems, which could reduce the need for primary material inputs.[7] While the availability of iron is generally considered secure, materials such as graphite, lithium, nickel, cobalt, manganese, phosphate, copper, and rare earths[8] are classified as critical raw materials by policymakers and industry experts, particularly in the context of policy for sustainable and resilient supply chains. Against this backdrop, the following analysis spotlights these materials while placing a special focus on Africa.

What is the current status of African raw material production for electric mobility?

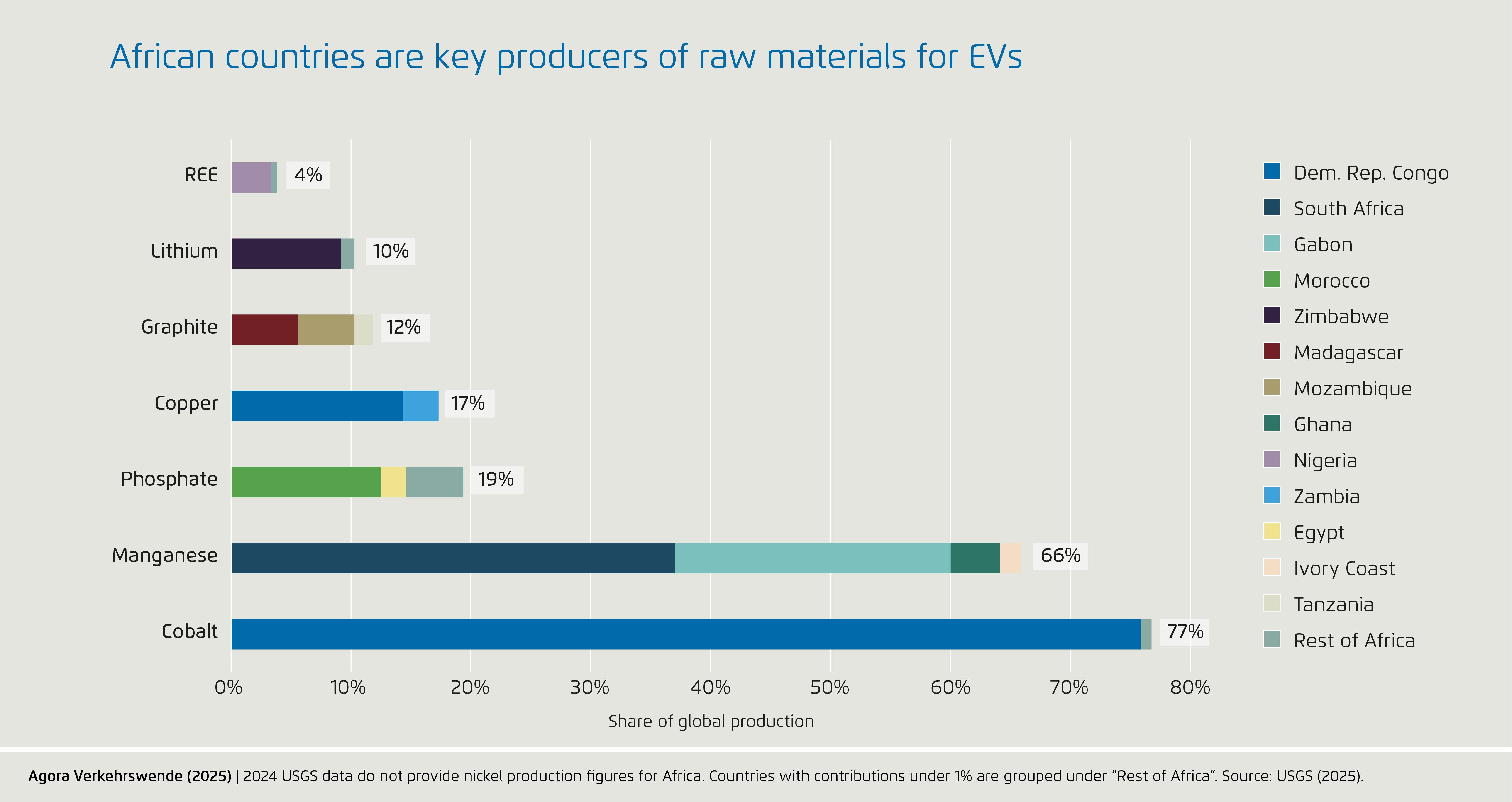

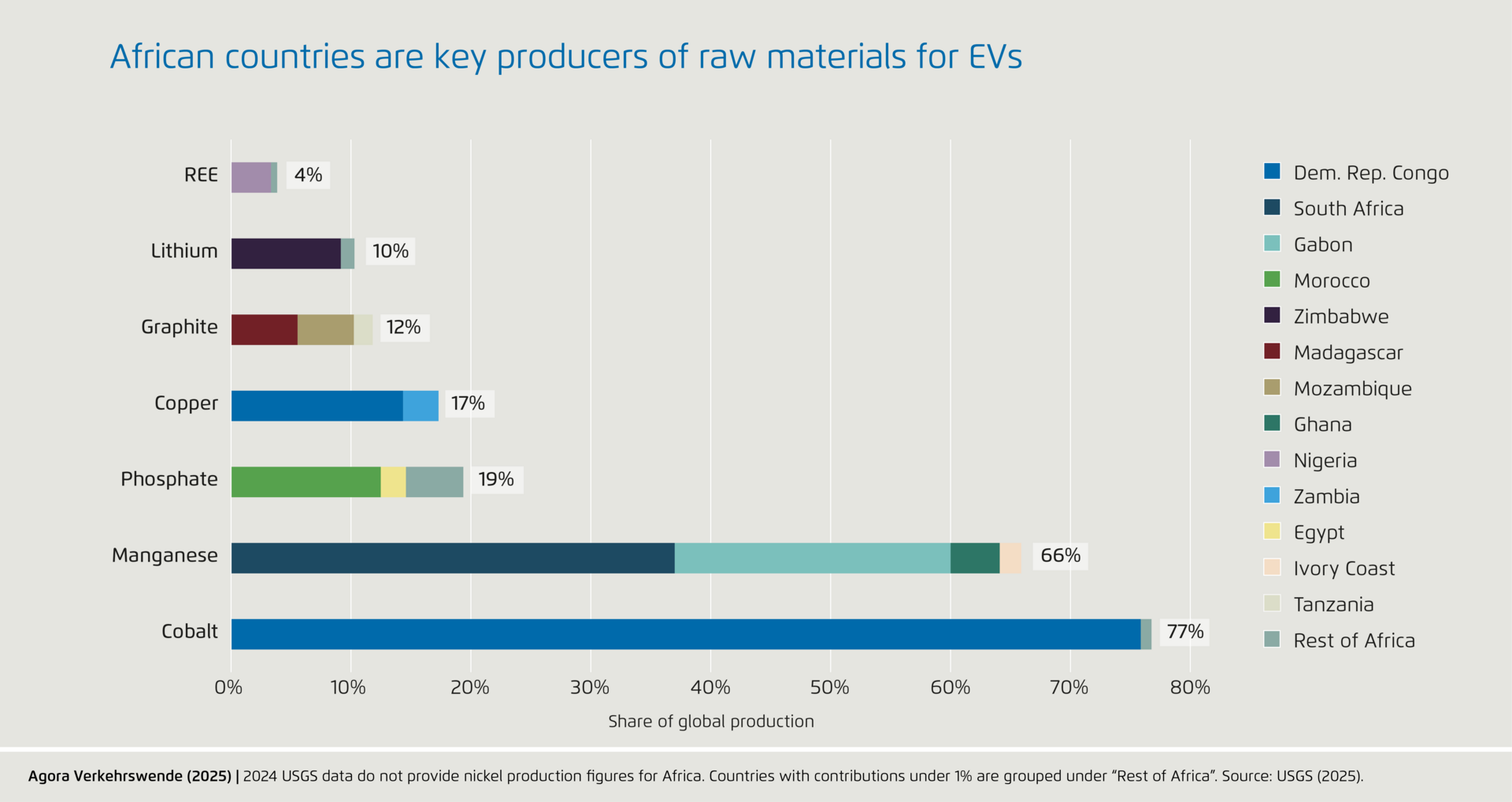

African countries are key suppliers of raw materials for EVs: The African continent hosts a vast range of raw materials that are essential for a successful global transition to clean technologies. In the subdomain of electric mobility, data from the United States Geological Survey (USGS, 2025) show that various resources, including in particular cobalt and manganese production (essential for NMC batteries), are concentrated to a significant extent in African countries (see Figure 2). The Democratic Republic of the Congo (DRC) is by far the world’s largest producer of cobalt, accounting for approximately 74% of current global output. Likewise, African countries taken together are the largest manganese producers. Manganese production is geographically more distributed than cobalt, taking place primarily in South Africa (37 %) and Gabon (23 %), although Ghana and Côte d’Ivoire show rising production volumes. In addition to cobalt, the DRC is also a major producer of copper, accounting for more than 14% of global production. Concerning LFP battery materials, Morocco plays a key role in phosphate production, representing around 13% of today’s global output. Africa is also active in the extraction of other critical raw materials such as graphite (Madagascar, Mozambique, Tanzania) and lithium (Zimbabwe, Namibia), though current production shares remain comparatively small, as global output is dominated by countries in Latin America (lithium) and China (graphite). The same applies to rare earth elements (REEs), which at present are predominantly mined in China. The 2024 USGS data do not list nickel production, given Africa’s minimal share of global output (which is dominated by Indonesia).

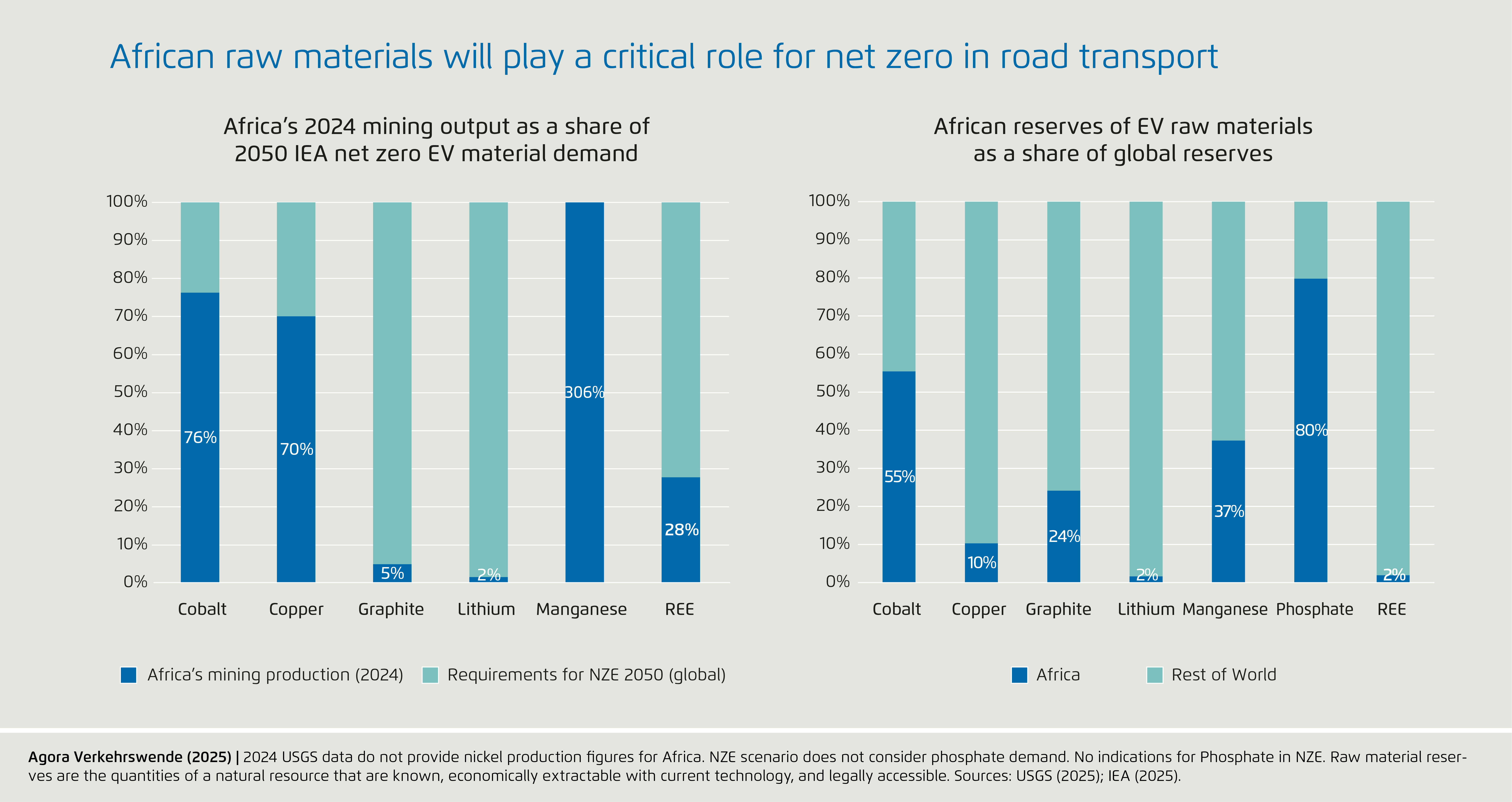

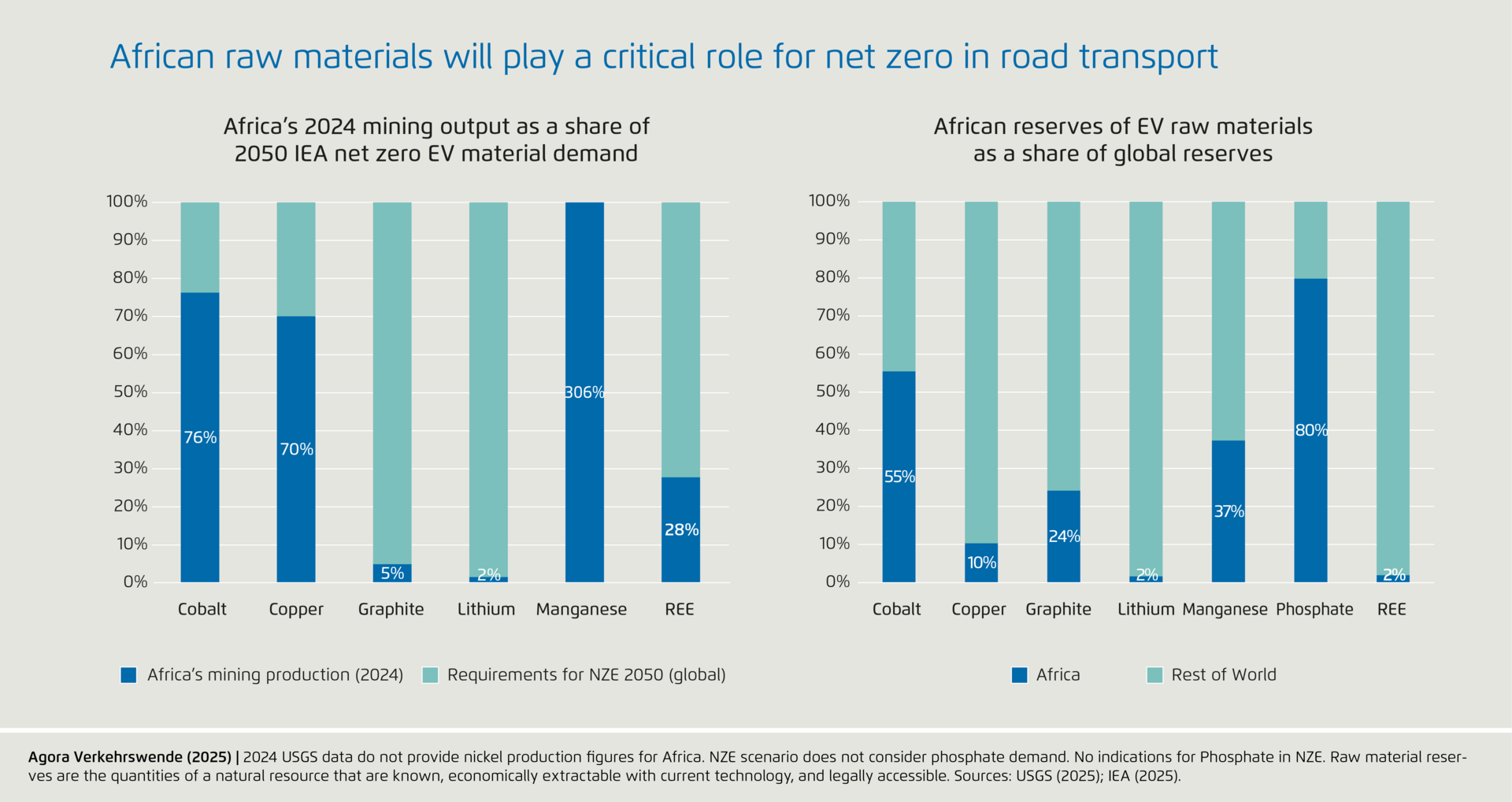

African raw materials will play a critical role for net zero in road transport on the continent and beyond: Africa’s importance for the global supply chains of raw materials that are critical for electric mobility becomes particularly evident when comparing its current mining production with the projected requirements under the IEA Net Zero Emissions (NZE) scenario, which gives an indication of future global demand as part of the transition to carbon neutrality. As illustrated in the left graph in Figure 3, today’s African mining output could already satisfy a significant share of the annual raw material demand required to reach net zero, particularly for cobalt and copper. While cobalt demand for EV batteries is expected to decline over time due to the growing adoption of LFP battery technology, copper demand will continue to increase with overall EV deployment, suggesting that Africa could secure substantial market shares if current production levels are maintained. Current reserve shares indicate that there is underutilized potential to do so (see right graph). Similarly, manganese production in Africa currently exceeds projected NZE requirements. While demand for NMC batteries may decline in the future, Africa could leverage its existing production capacity and reserves to supply remaining global demand.[9]

Further potential exists for Africa to gain additional global market share in key raw materials such as lithium and graphite: Africa’s current production of critical battery materials such as graphite and lithium represents only a small share of global supply and thus is insignificant in context of the NZE scenario. A substantial increase in production would be required for the continent to become a major player and capture future revenue streams, particularly as LFP batteries come to dominate the market, as currently forecasted.

By contrast, lithium reserves appear limited, according to current estimates. However, this assessment reflects the strict definition of “reserves” as economically exploitable resources; reserve estimates can thus change given technological advancements and market developments. Recent reports indicate additional exploitable lithium resources in Morocco, for example.[10] In the case of graphite, African countries, which boast some 25% of global reserves, have significant opportunities for expanding production. While the NZE scenario does not provide specific projections for phosphate, this material is also likely to play a crucial role in LFP batteries; in this connection, Morocco already produces phosphate and has particularly significant reserves.

In the case of rare earth elements (REEs), current African production only represents a small share of global supply. However, Africa could meet approximately 28% of the demand projected under the NZE scenario. In this way, even if emerging electric motor technologies reduce REE requirements per vehicle, African reserves could become strategically important if global demand grows, or if new applications arise. This is a particularly valid consideration given recent developments in the area of Chinese export restrictions, as China is currently the dominant producer of REEs.[11]

Where does Africa stand in the global value chain for raw materials used in electric mobility?

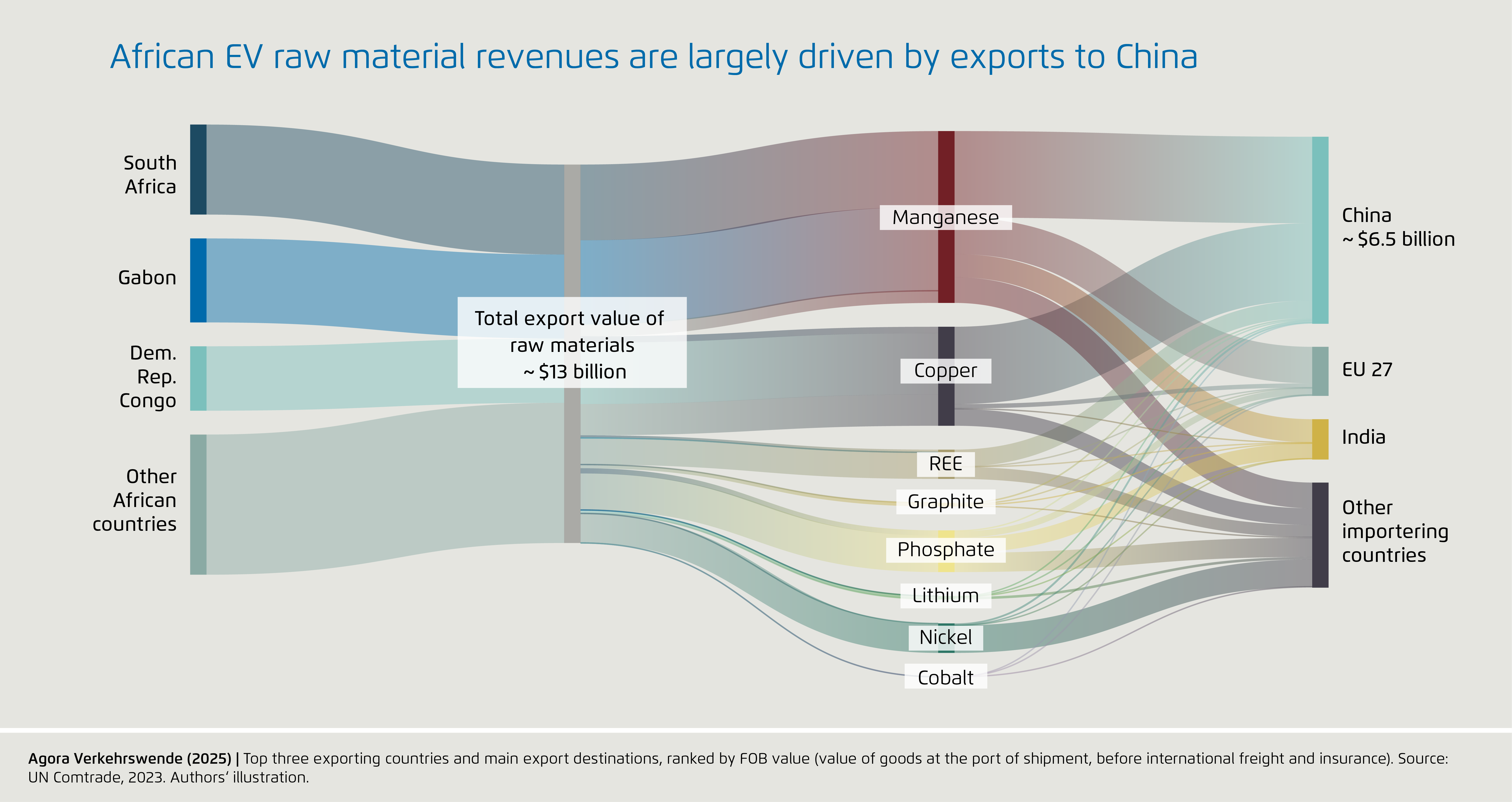

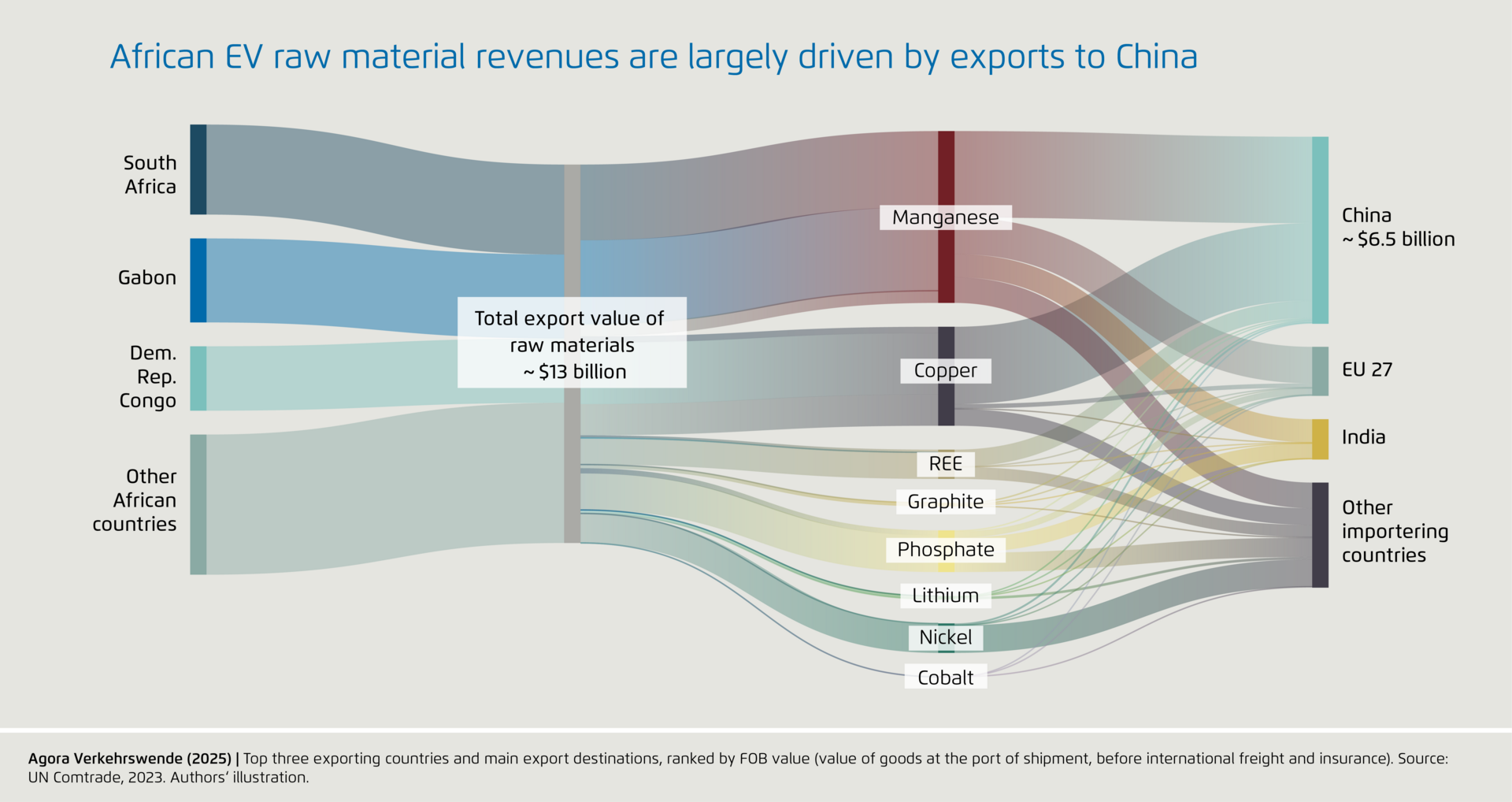

Africa continues to export raw materials on a large scale, adding limited value domestically: The diagram below (figure 4) shows trade flows by export value. It reveals that China accounts for nearly half of the export value of unprocessed African raw materials, followed by the European Union and India. Among African countries, South Africa is the leading importer (with a roughly 6% share), reflecting its relatively advanced processing capacity. In terms of net weight, Africa produced approximately 67 million tonnes of EV-relevant raw materials in 2023, according to the USGS, of which around 56.5 million tonnes were exported to countries outside the continent, according to the UN Comtrade Database.[12] This suggests that around 84% of Africa’s EV-relevant raw materials left the continent without significant domestic processing. The fact that the value of Africa’s EV raw material exports totaled only around USD 13 billion highlights a missed economic opportunity, given the substantial value that could be captured domestically.

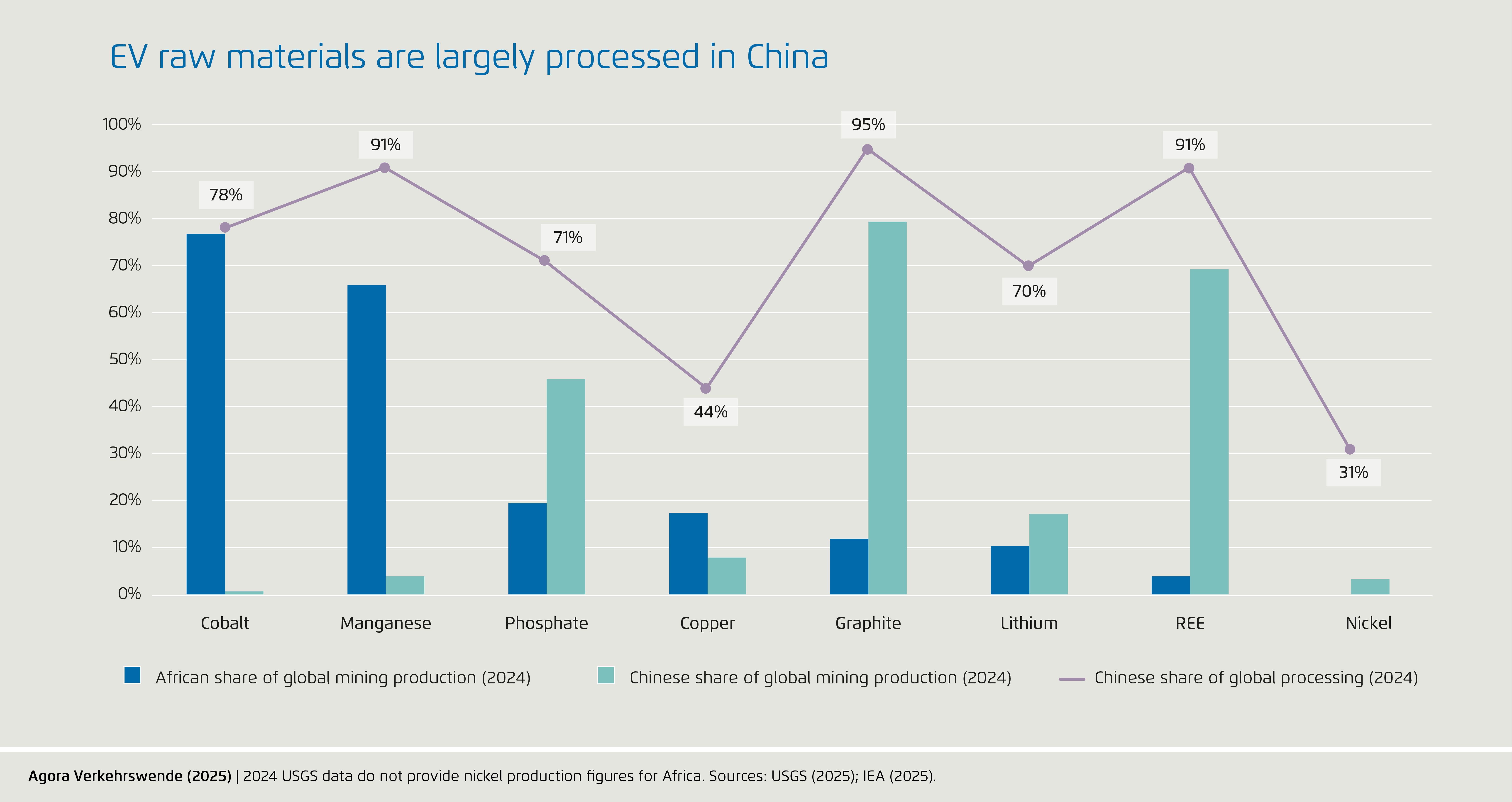

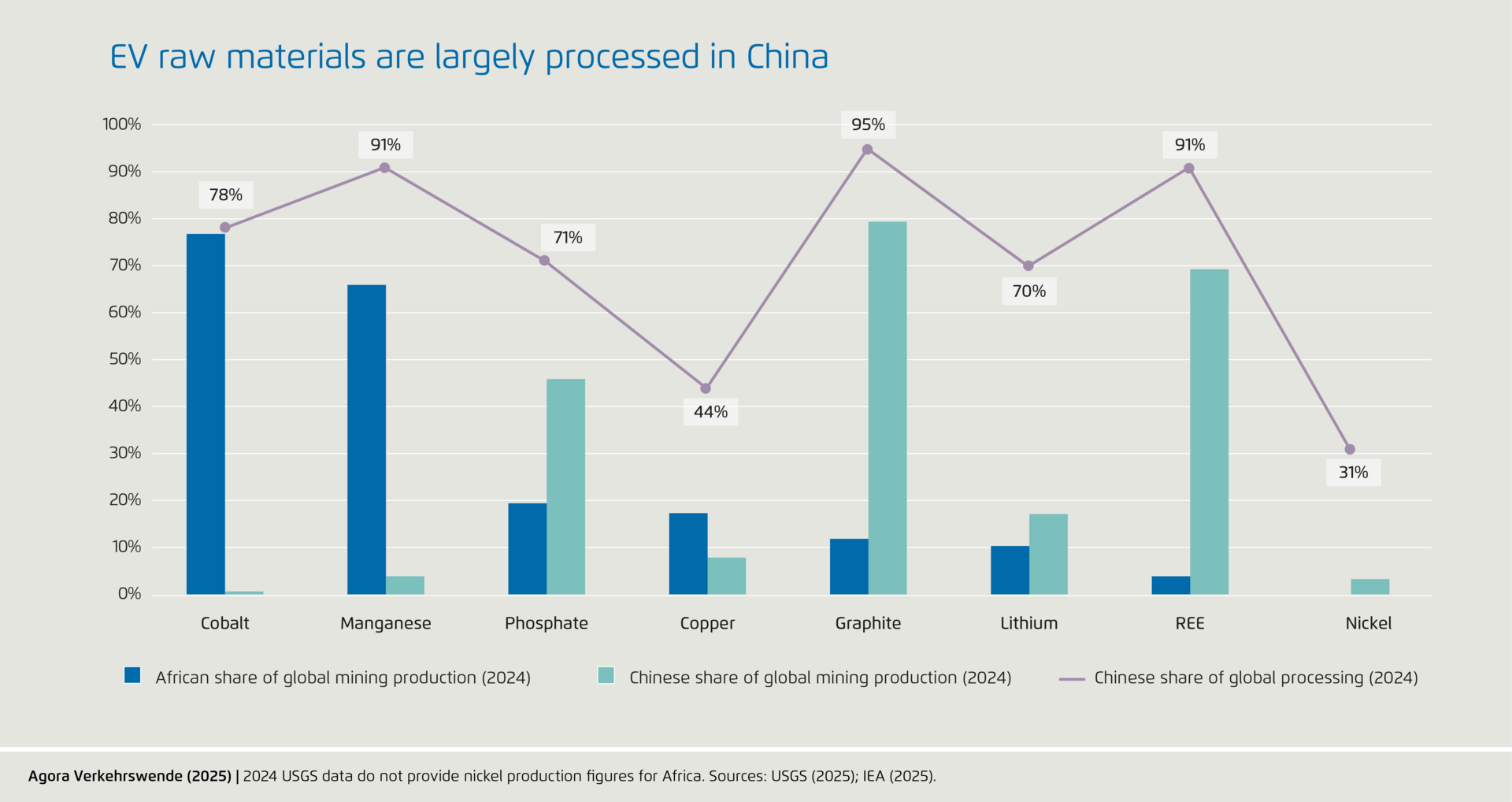

Domestic processing capacity differs by country but remains insufficient overall: A closer look at country-specific trade patterns and critical raw materials is illuminating. For example, the DRC exports mostly refined copper, while Zambia still relies heavily on unprocessed copper, highlighting the uneven development of local beneficiation across African mining countries.[13] The same study concludes that there is a stark contrast between the limited scale of existing beneficiation facilities and Africa’s raw material production capacity. With roughly half of the continent’s 215 facilities focused on comminution and only about 20% each on smelting and refining, current processing capacity is largely insufficient given CRM production levels and anticipated growth in global demand.[14] In fact, IEA data underline that China is the single largest processor of most EV raw materials considered in this analysis, except for nickel (see Figure 5).[15]

When also considering the export revenue analysis above, which identifies China as the primary importer of African raw materials for electric mobility, these findings highlight China’s strategic positioning across all major stages of the value chain for EVs. From importing critical raw materials - including ownership stakes in mines in Africa, particularly in the DRC[16] - to processing these elements domestically, manufacturing battery components, and ultimately assembling batteries, China is able to capture substantial value and exert control over key supply chains for electric mobility.[17] Consequently, any strategy aimed at enabling Africa to secure greater value from its raw materials has to take China’s recently dominant role and specific interests into account.

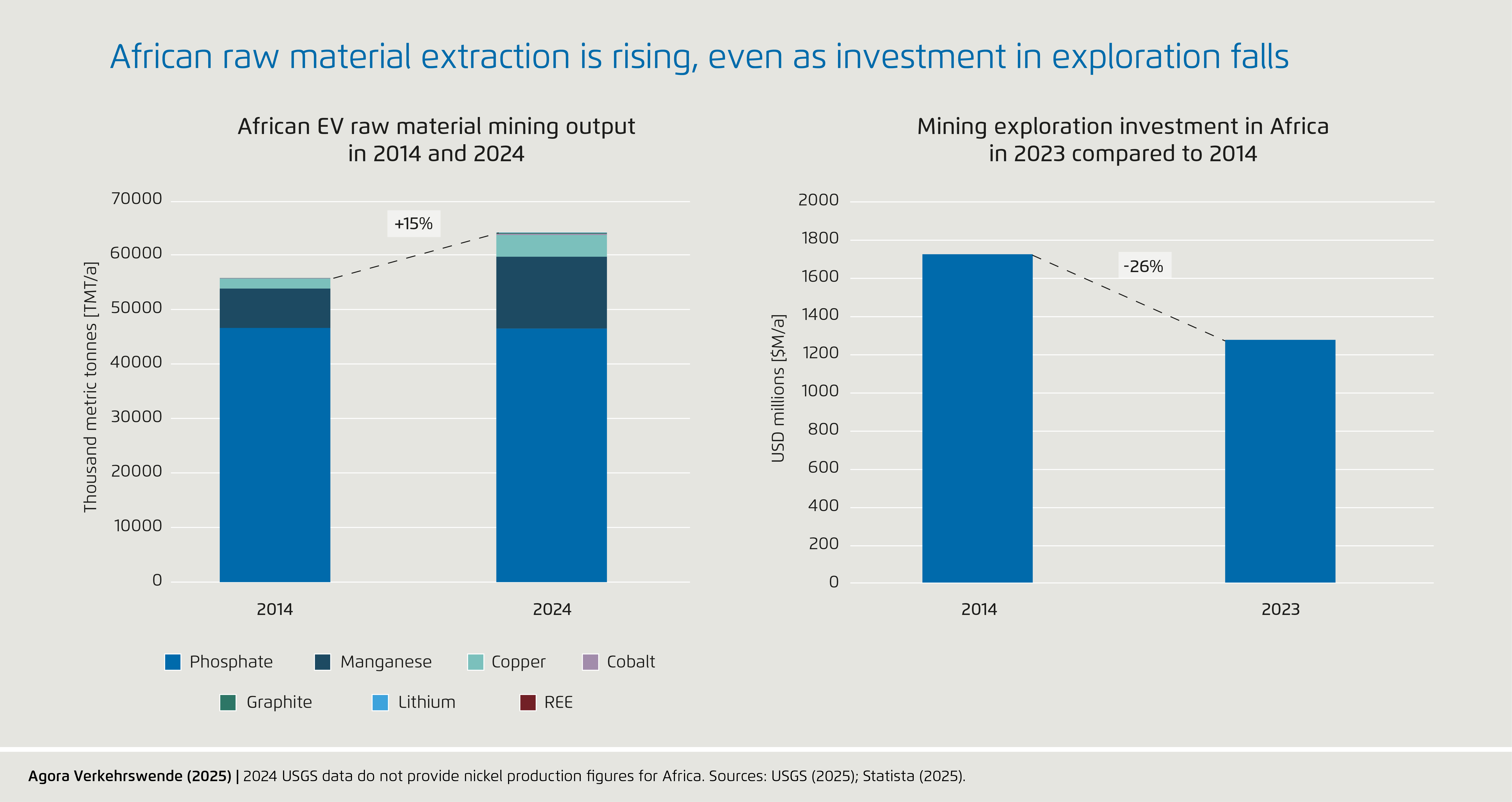

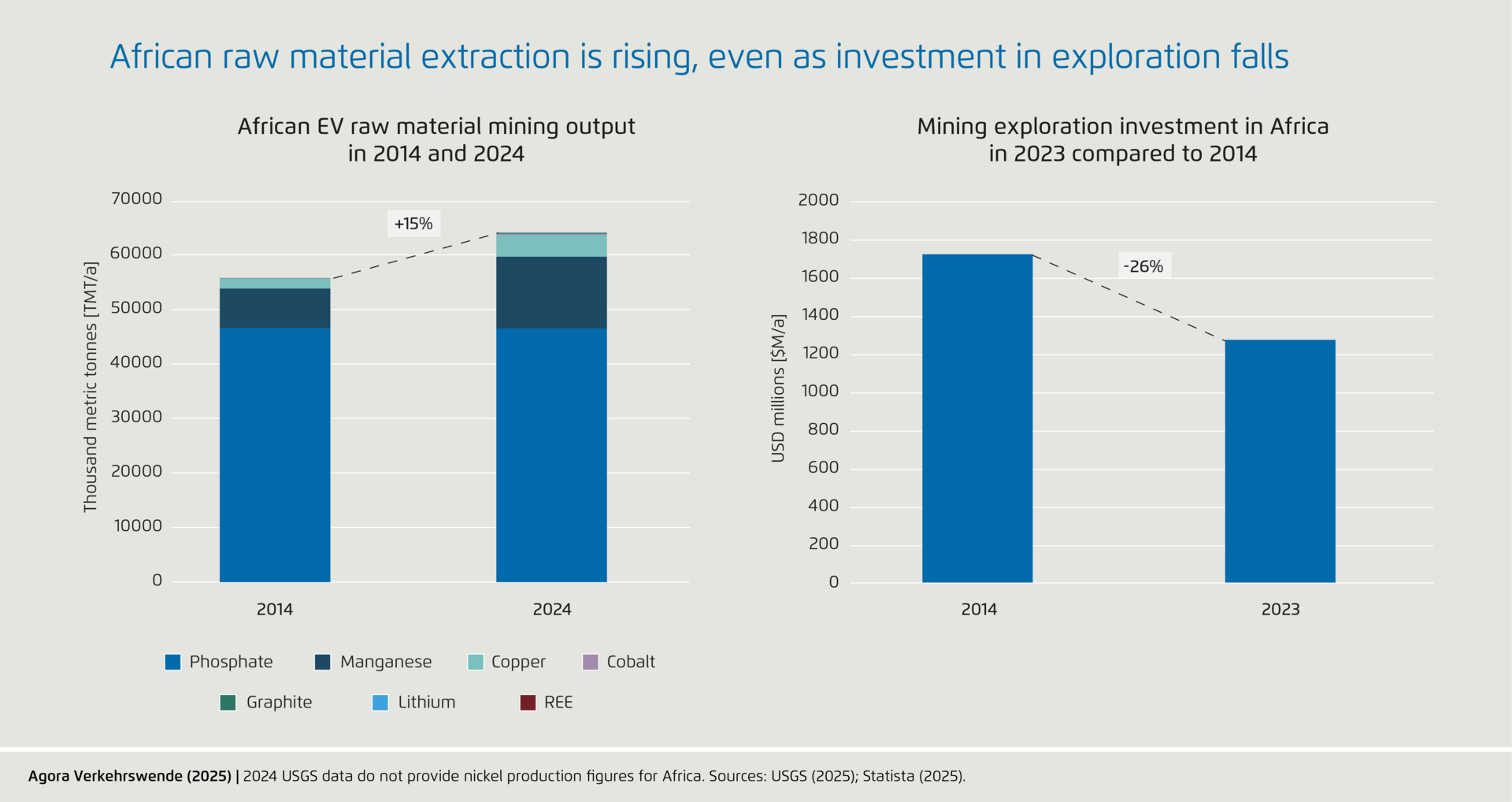

While EV raw material production at existing mines is rising, investment in exploration for new mines is on the decline: Between 2014 and 2024, Africa’s overall mining output by weight increased by roughly 15%. While phosphate rock, the heaviest raw material among those examined, remained relatively stable, production of all other key minerals grew substantially. Graphite and lithium output rose by more than 90%, while the production of manganese and copper, already at high levels, increased by around 50%. Recent data show that exploration investment in Africa has declined in absolute terms, from over USD 1.6 billion in 2014 to just over USD 1.2 billion in 2023 (see Figure 5).[18] Over the same period, the continent’s share of global mining exploration investment also fell, from 16% to 10%, reflecting both the decline in absolute investment and faster growth of exploration spending in other regions such as Canada and Australia.

This divergence between rising mining output and declining investment highlights the complex dynamics shaping Africa’s mineral sector. On the one hand, increased output reflects strong global demand for energy transition minerals. On the other hand, persistent regional challenges, including financing risks, political uncertainties as well as protective industrial policies, may have contributed to a lower inflow of foreign direct investment and are likely behind falling outlays for exploration.[19] Much of the recent production growth seems to have come from the expansion of existing operations rather than from new projects or exploration. Given declining investment in exploration and production, revenues from resource extraction could remain stagnant or even decline, with knock-on effects for domestic economic performance. These trends are further compounded by Africa’s limited raw material processing capacity, as mentioned before.

How can Africa benefit from its raw materials for electric mobility?

Encouraging linkages to the EV sector could create added value: While establishing domestic capacities for downstream processing would undoubtedly enhance the value of exported materials and increase export revenues, there is also significant potential for strengthening upstream linkages, particularly in the supply of mining equipment, technology, and R&D. While developing these linkages presents growth opportunities, such a development strategy is not without risks, for it could increase dependence on the profitability of the extractive sector.[19] Given fluctuating prices, global demand and ongoing technological shifts – including, for instance, the transition from NMC to LFP battery chemistries – excessive reliance on the extractive sector may pose substantial risks to long-term economic stability.[20] For this reason, the development of horizontal linkages to other industries, including the transport and electric vehicle sectors, could therefore have particular strategic value.[21] Such a strategy would reduce dependence on international raw material markets while leveraging the skills and capabilities developed in the mining sector to move into new, higher value-added industries. For example, the specialized equipment and know-how used in mineral exploration and extraction can also find applications in other sectors, including the mechanical engineering required for EV manufacturing, thus broadening the industrial base and fostering economic resilience.[22] This would allow locally produced raw materials to feed into domestic high-value industries such as EV production while also advancing the green transition within mining countries.

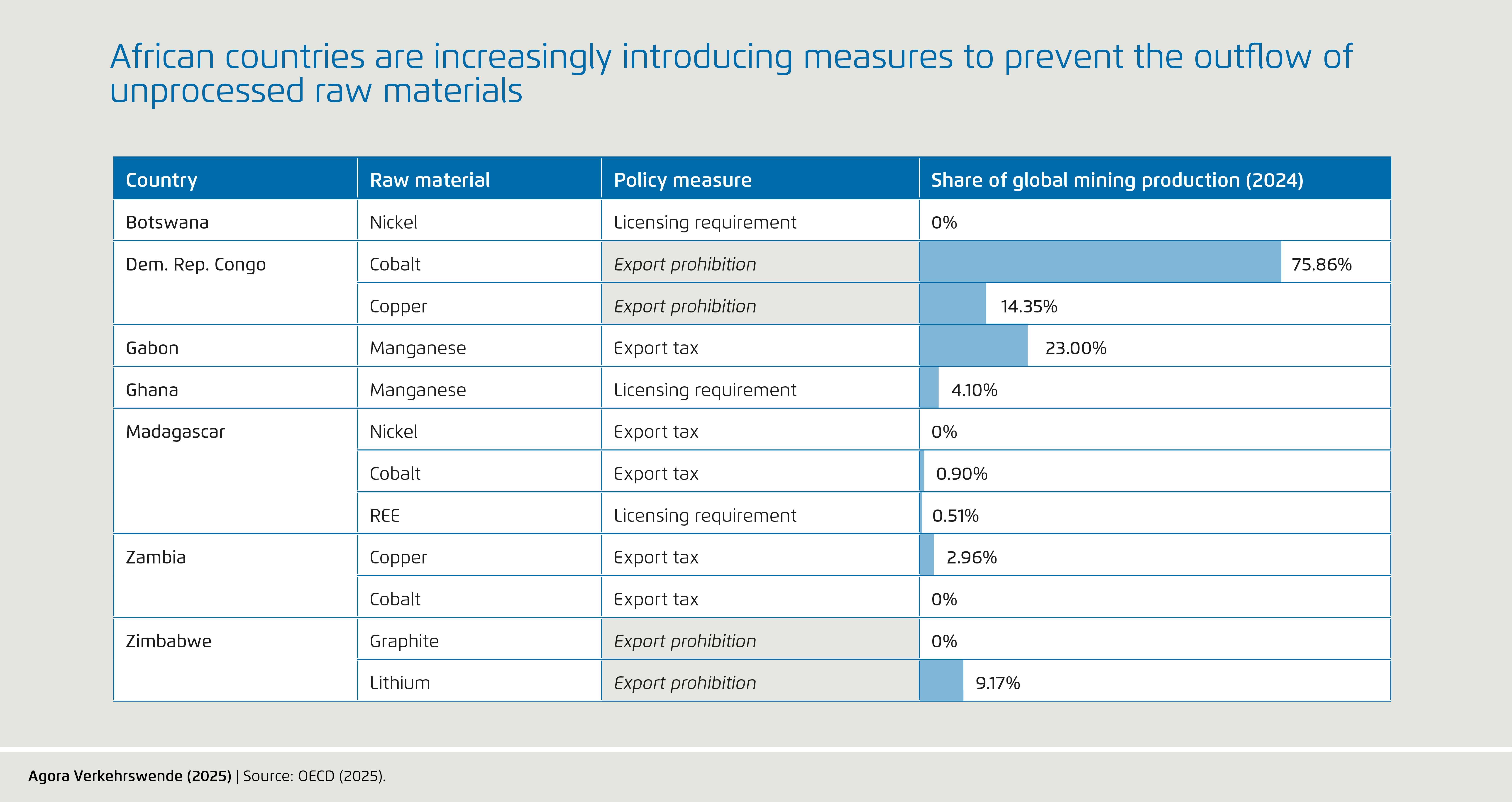

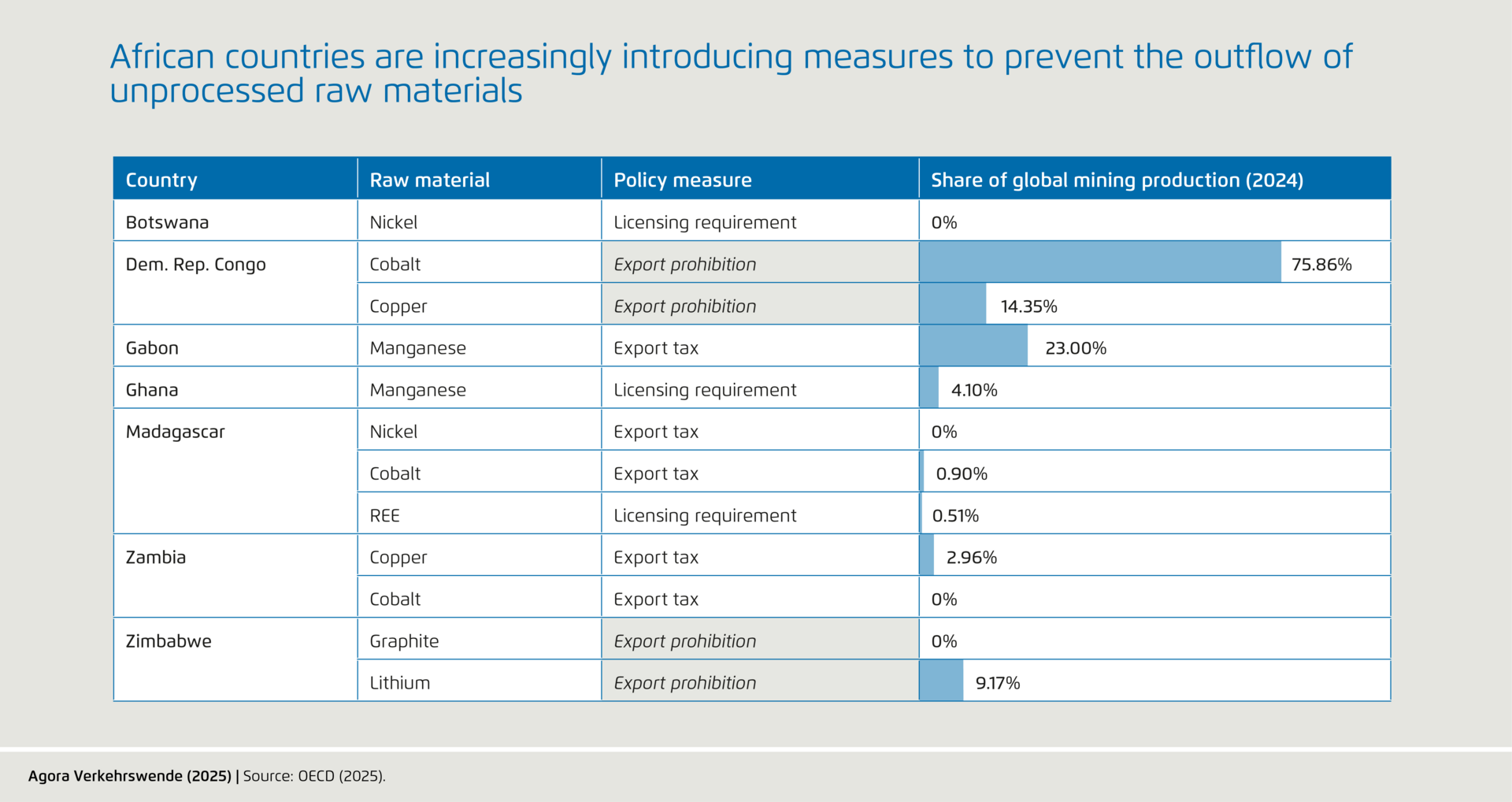

For clusters to emerge, decisive policy action is needed: Establishing linkages across the value chain can be difficult in practice, for this requires coordinated industrial policy action and sustained strategic cooperation over time. A country’s capacity to pursue such a strategy will depend on numerous factors, including existing industrial capacity, access to affordable energy, the existing infrastructure base, human capital availability,[23] and access to affordable finance. Nonetheless, African countries have been increasingly taking action to enhance the value added derived from the minerals industry. Export restrictions on unprocessed raw materials, such as those implemented by the Democratic Republic of Congo (DRC) and Zimbabwe, are one example of policy action in this area (see Figure 6).[24] Other countries have introduced additional measures to penalize the export of unprocessed minerals. While such policies typically aim to support the development of domestic processing capacity, they also signify a trend towards growing market barriers, rather than mutually beneficial regional cooperation. Insofar as such measures undermine regional cooperation, this could mean lost opportunities for the international pooling of expertise and infrastructure, with attendant negative effects for regional industrial capacity and value creation.

One example of a promising development in the area of regional cooperation – yet one that also faces significant challenges – is the envisioned collaboration between Zambia and the DRC to establish a “battery cluster” for joint precursor and component production.[26] Such initiatives could potentially pave the way for the development of integrated industrial clusters that take advantage of key raw material resources, with growing and progressively expanding capacities in extraction, local materials processing, battery manufacturing, and ultimately electric vehicle production. To support such interlinked development, a promising path is to develop industrial policy frameworks that are attuned to country-specific strengths and weaknesses. Most critically, this includes fostering robust demand for electric mobility within African countries, as strong local offtake provides the economic anchor necessary for sustained investment. Only by ensuring predictable demand for locally produced batteries and vehicles can self-sufficient and long-term sustainable e-mobility clusters emerge, effectively linking mining, processing, battery production, and vehicle assembly across the region.

African countries become a lead market for electric mobility: However, a critical catalyst for realizing these linkages is the development of robust local and regional electric mobility markets. Predictable demand for electric vehicles and related components in Africa would provide additional economic incentive for companies to invest in processing, battery production, and vehicle assembly in the first place. By reducing offtake uncertainty for these goods, electric vehicle markets can support the local growth of new supply chains – particularly in high value-added segments – while also leveraging mining capabilities to unlock broader industrial development.

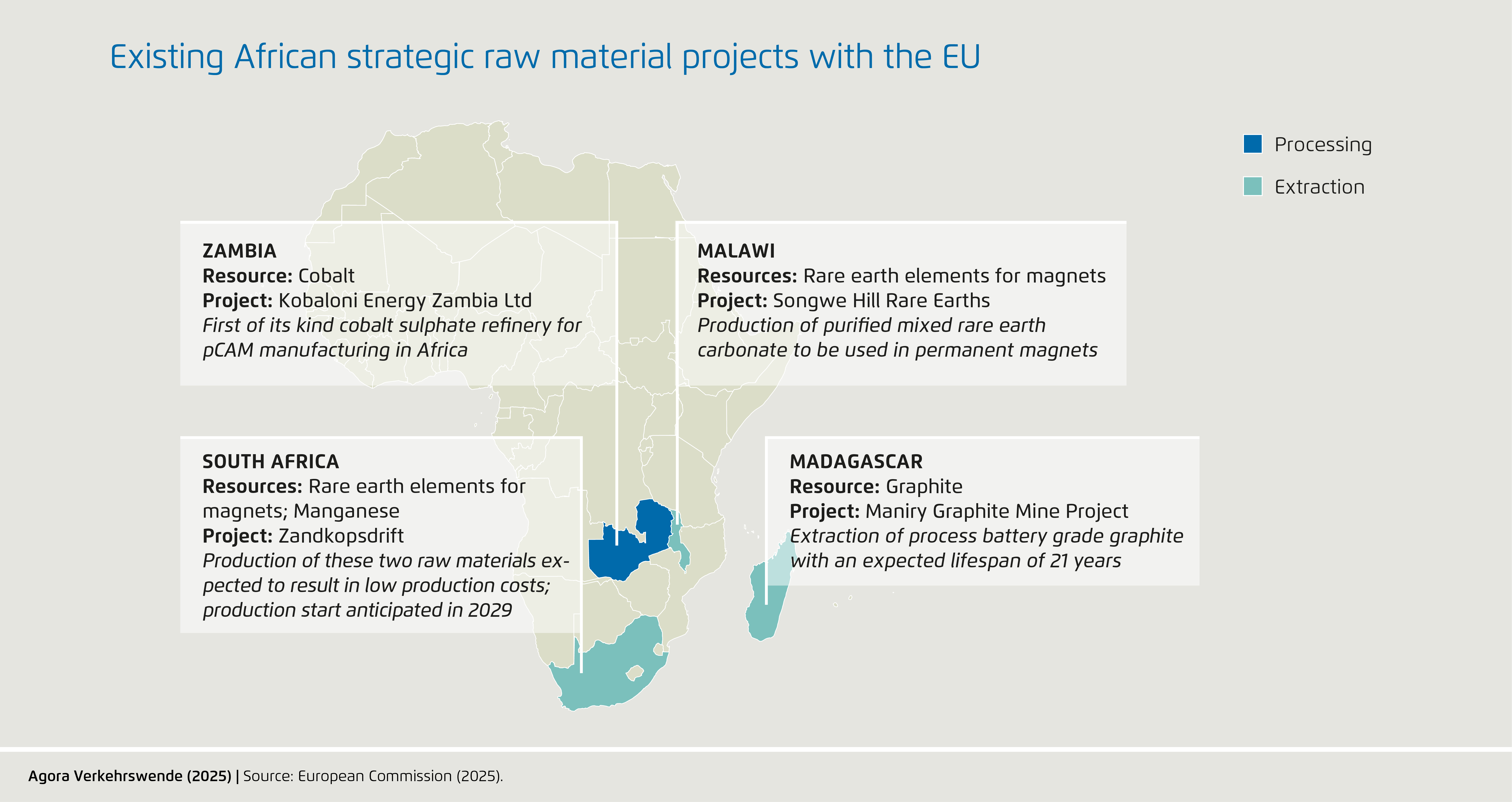

Africa–EU Cooperation promises to yield significant mutual benefits: African countries can enhance and expand industrial capacities by pursuing stronger international cooperation with international partners such as the EU. As part of its Critical Raw Materials Act, the EU has identified 13 strategic projects outside the union, four of which are located on the African continent (see Figure 7). These partnerships aim to bolster EU supply chain resilience while also supporting domestic value creation in partnering countries. However, implementation faces challenges, including institutional fragmentation within the EU; industrial policy tensions that (at the moment) prioritize capacity building within the EU; and, perhaps most critically, financing constraints that can hinder long-term project commitments. Projects connected to the mining value chain are highly capital intensive, and are subject to various risks, including uncertain offtake.[27] Sustained EU support, particularly in facilitating offtake agreements with European companies, could provide African producers with stable revenue streams while ensuring secure access for European industries. However, despite engagement from the European Investment Bank and European Bank for Reconstruction and Development or the Global Gateway Initiative, no dedicated EU funding mechanism currently exists for raw materials cooperation. However, the announced EU Energy and Raw Materials Platform could be a promising springboard for bringing together actors on both the supply and demand sides.[28] Ultimately, EU support for projects across the entire value chain – from mining to processing and beyond – could be important for strategic partnerships to be successful and reap mutual benefits.

In light of the above, one particularly promising avenue for EU–Africa partnership is to support the development of domestic and regional electric mobility markets in Africa. Creating demand for locally processed minerals and domestically manufactured battery components would reduce offtake uncertainty, thus increasing the bankability of long-term investments in corresponding industrial capacities. The EU, for its part, would benefit from the strategically relevant diversification of raw material sourcing, thus ensuring partnerships with Africa are founded on genuine reciprocity. Nonetheless, sufficient financial backing is required to unlock the advantages that such cooperation could bring in terms of raw material access for Europe and economic development for Africa.

Summary: Advancing the development of African electric mobility clusters that harness domestic raw materials

The African continent holds immense potential in the raw materials sector. Several of the countries analyzed here are already major supplier and/or possess significant reserves. Yet the continent faces three interrelated challenges:

First, the processing of raw materials largely occurs abroad, particularly in China. This represents a missed opportunity for local value creation, revenue growth, and the development of domestic industrial capabilities in Africa.

Second, while mining output has increased, investment in mining operations on the continent is declining. This trend threatens revenue streams from natural resource extraction while also jeopardizing local economic stability, given that mining constitutes a major share of the export portfolios of many African countries.

Third, and perhaps most critically, the mining sector in many African countries remains largely disconnected from the rest of the economy. Downstream industries, such as raw materials processing for battery-grade anode or cathode materials, are largely absent. Upstream and horizontal linkages, such as to EV manufacturers and associated part suppliers, are also limited. Integrated regional supply chains could unlock significant economic opportunities: Locally mined raw materials such as lithium, cobalt, and graphite could be refined into battery-grade materials within Africa. These materials could then serve as inputs to domestic battery manufacturing plants. Domestically produced batteries could supply emerging EV manufacturing and assembly industries, enabling countries to capture a greater share of value added, from extraction to final vehicle production, all while creating high-quality jobs for skilled workers, improving balance of trade, and increasing the sustainability of the transport sector.

A decisive lever for unlocking these linkages is the development of local and regional markets for EVs and upstream industries. By creating predictable and growing demand for electric vehicles, such markets would provide a stable anchor for investment in processing, precursor production, and battery manufacturing. This demand would reduce offtake uncertainty, increase the bankability of capital-intensive projects, and incentivize firms to locate additional stages of the value chain within African economies.

Several factors currently impair the exploitation of these opportunities: limited industrial capacity, infrastructure bottlenecks, political and regulatory hurdles, and – not least – restricted access to affordable finance. Actors in the EU have also been increasingly pursuing partnership with African countries given the need to secure raw materials for their domestic industries. Strategic partnerships between the EU and African countries could help address some of the challenges spotlighted in this analysis while also generating a panoply of mutual benefits. However, tapping the full scope of latent opportunity will require the facilitation of projects across the entire value chain, from initial raw materials extraction to their utilization in the production of high-value final goods. This also means that EU partnerships should explicitly support the emergence of local and regional EV markets in Africa, as these markets create the demand base needed to undergird processing, battery production, and vehicle assembly within the continent. Without such demand-side development, many supply-chain investments will struggle to materialize or reach scale. Achieving this will require coordinated efforts across multiple areas, including finance, but if successful, it would represent an enormous opportunity for both Africa and the EU: Driving industrial upgrading and job creation across the African continent while securing reliable access to critical raw materials for Europe.

[1] Each battery cell consists of an anode, cathode, separator, and electrolyte. During the charging and discharging of LFP and NMC batteries, lithium ions shuttle between the anode and cathode through the electrolyte. Sodium-ion batteries rely on sodium rather than lithium, but they are not (yet) widely used in transport applications due to their lower energy density.

[2] IEA (2025b): Global EV Outlook 2025. Paris. URL: https://iea.blob.core.windows.net/assets/7ea38b60-3033-42a6-9589-71134f4229f4/GlobalEVOutlook2025.pdf.

[3] IDTechEx (2025): ‘Electric Motors for Electric Vehicles 2024-2034’. URL: https://www.idtechex.com/en/research-report/electric-motors-for-electric-vehicles-2025-2035-technologies-materials-markets-and-forecasts/1031.

[4] For the purposes of this analysis, these materials are collectively referred to as “rare earth elements” (REEs).

[5] Copper Development Association (2025): ‘Electrification and Energy Efficiency: Copper´s role in the EV revolution’. URL: https://www.copper.org/copperconversations/thought-leadership/electrification-and-energy-efficiency-coppers-role.php?

[6] IEA (2025a): Global Critical Minerals Outlook 2025. URL: https://iea.blob.core.windows.net/assets/ef5e9b70-3374-4caa-ba9d-19c72253bfc4/GlobalCriticalMineralsOutlook2025.pdf.

[7] For further information on the development of the battery cell market, see Agora Verkehrswende (2025) and for insights on battery recycling, see Agora Verkehrswende, Stiftung GRS Batterien, and Öko-Institut (2025): Stoffkreisläufe für Antriebsbatterien. Berlin. URL: https://www.agora-verkehrswende.de/veranstaltungen/stoffkreislaeufe-fuer-antriebsbatterien.

[8] For simplicity, this paper refers to graphite instead of natural graphite, phosphate instead of phosphate rock, lithium instead of lithium compounds (e.g., lithium carbonate or hydroxide).

[9] Agora Verkehrswende (2025): A strong European battery industry for a strong automotive sector. Berlin. URL: https://www.agora-verkehrswende.org/publications/a-strong-european-battery-industry-for-a-strong-automotive-sector.

[10] GTAI (2025b): ‘Marokko fördert Lithiumabbau als Basis für Batteriefertigung’. URL: https://www.gtai.de/de/trade/marokko/branchen/lithium-marokko-batteriefertigung-1908696.

[11] Financial Times (2025): ‘Western companies warn of China rare-earth supply chain chaos’. URL: https://www.ft.com/content/55322307-739c-4915-96f6-9f059b460975.

[12] Included Harmonized System (HS) Codes: Cobalt (2605), Copper (2603), Natural Graphite (2504), Manganese (2602), Nickel (2604), and Natural Phosphates (251010); however, Rare Earth Element (REE) ore is categorized under the broader code 253090 ("Mineral substances n.e.c. in chapter 25") and Lithium ore under 261790 ("Ores and concentrates n.e.c. in chapter 26"), which contain other, minor raw materials not specific to EV technology.

[13] A comparison between USGS production data (gross weight of ore/concentrate) and UN Comtrade export data (net weight of trade shipments) was conducted to estimate the proportion of raw material outflow from the continent. Although the two sources differ in their definitions of commodity weight and content, they provide a reasonable basis for an indicative estimation.

[14] IGF (2024): Critical Raw Materials: A production and trade outlook | Perspectives from African, Caribbean, and Pacific States. URL: https://www.iisd.org/publications/report/critical-raw-materials-production-trade-outlook.

[15] ibid. Data in the study are from 2023.

[16] IEA (2025a): Global Critical Minerals Outlook 2025. URL: https://iea.blob.core.windows.net/assets/ef5e9b70-3374-4caa-ba9d-19c72253bfc4/GlobalCriticalMineralsOutlook2025.pdf.

[17] AidData (2025): ‘Chasing copper and cobalt: China’s mining operations in Peru and the DRC’. URL: https://www.aiddata.org/blog/chasing-copper-and-cobalt-chinas-mining-operations-in-peru-and-the-drc.[18] Agora Verkehrswende (2025): A strong European battery industry for a strong automotive sector. Berlin. URL: https://www.agora-verkehrswende.org/publications/a-strong-european-battery-industry-for-a-strong-automotive-sector.

[19] This data also includes investment in raw materials other than those relevant for this analysis.

[20] CSIS (2025): ‘Underexplored and Undervalued: Addressing Africa’s Mineral Exploration Gap’. URL: https://www.csis.org/analysis/underexplored-and-undervalued-addressing-africas-mineral-exploration-gap.

[21] SWP (2025): The EU’s External Raw Materials Strategy: Key Fields for Action. URL: https://www.swp-berlin.org/publications/products/fachpublikationen/250819_WP_FG6_EU%E2%80%99s_External_Raw_Materials_Strategy.pdf.

[22] IISD (2025): Critical Minerals for Africa’s Inclusive Growth and Development. URL: https://www.iisd.org/publications/report/critical-minerals-africa-development.

[23] Agora Verkehrswende (2023): Leapfrogging to Sustainable Transport in Africa. URL: https://changing-transport.org/publications/transforming-transport-in-africa/.

[24] SWP (2025): The EU’s External Raw Materials Strategy: Key Fields for Action. URL: https://www.swp-berlin.org/publications/products/fachpublikationen/250819_WP_FG6_EU%E2%80%99s_External_Raw_Materials_Strategy.pdf.

[25] The World Bank (2025): ‘Zambia’s Copper Opportunity: Can the Workforce Keep Up?’ URL: https://www.worldbank.org/en/news/feature/2025/09/10/zambia-s-copper-opportunity-can-the-workforce-keep-up?deliveryName=DM262627.

[26] According to new reports, the DRC lifted its export ban on cobalt and will introduce export quotas starting 16 October 2025: GTAI (2025a): ‘DR Kongo beendet Exportstopp für Kobalt und führt Quoten ein’. URL: https://www.gtai.de/de/trade/kongo/specials/export-kobalt-1932574.

[27] SWP (2025): The EU’s External Raw Materials Strategy: Key Fields for Action. URL: https://www.swp-berlin.org/publications/products/fachpublikationen/250819_WP_FG6_EU%E2%80%99s_External_Raw_Materials_Strategy.pdf.

[28] UNEP (2025): Financing the Responsible Supply of Energy Transition Minerals for Sustainable Development. United Nations Environment Programme. URL: https://doi.org/10.59117/20.500.11822/47718.

[29] European Commission (2025): ‘EU Energy and Raw Materials Platform’. URL: https://energy.ec.europa.eu/topics/energy-security/eu-energy-and-raw-materials-platform_en.

Bibliographical data

Downloads

-

Factsheet

pdf 1 MB

Africa’s Raw Materials for Electric Mobility at a Glance

How abundant raw materials for electric vehicles in Africa create opportunities for domestic development in partnership with Europe

All figures in this publication

LFP batteries for electric vehicles have gained significant market share in recent years

Figure 1 from Africa’s Raw Materials for Electric Mobility at a Glance on page 5

African countries are key producers of raw materials for EVs

Figure 2 from Africa’s Raw Materials for Electric Mobility at a Glance on page 6