-

Recycling traction batteries within the EU can make a substantial contribution to securing the automotive industry’s strategic raw material supply.

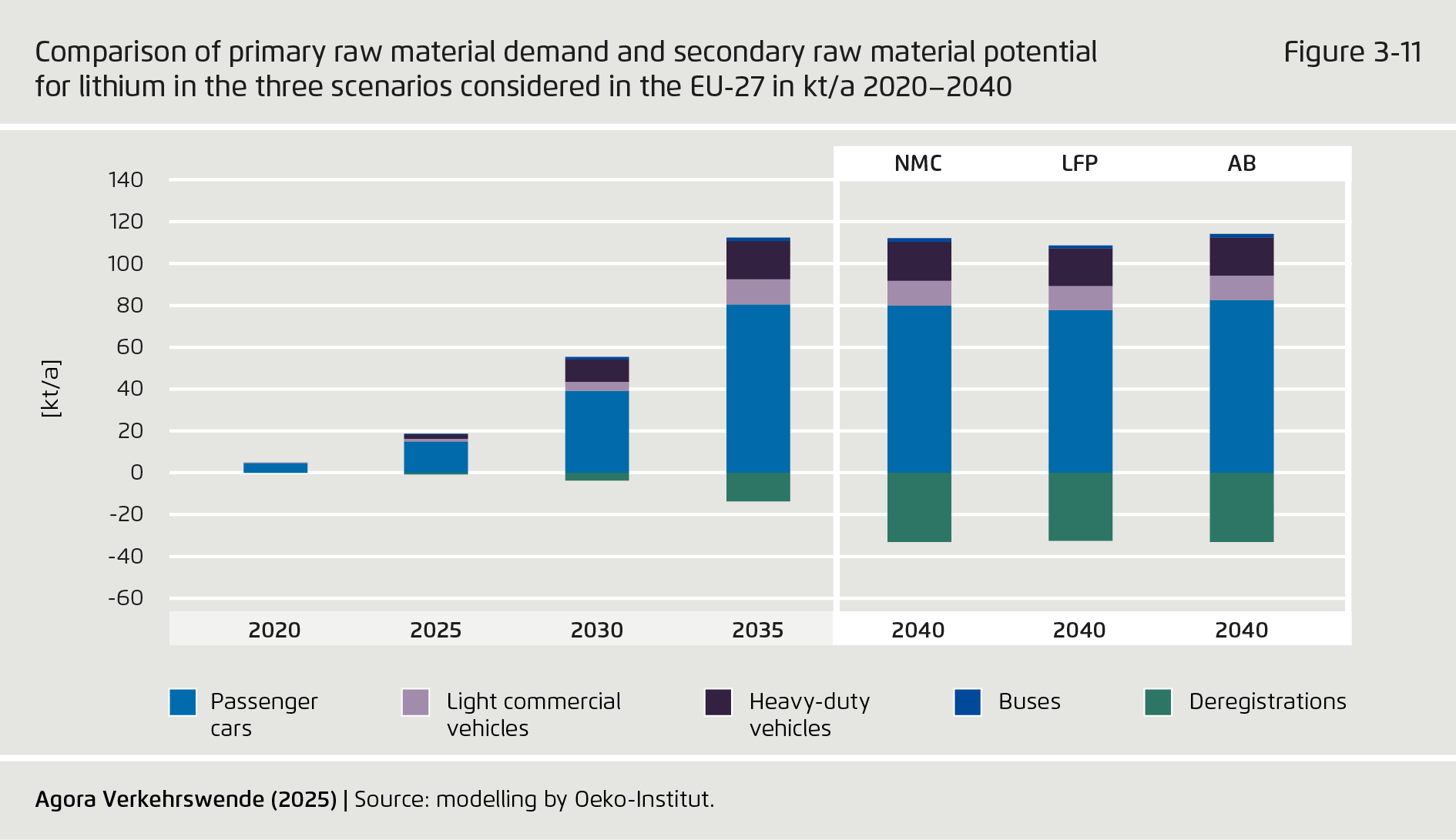

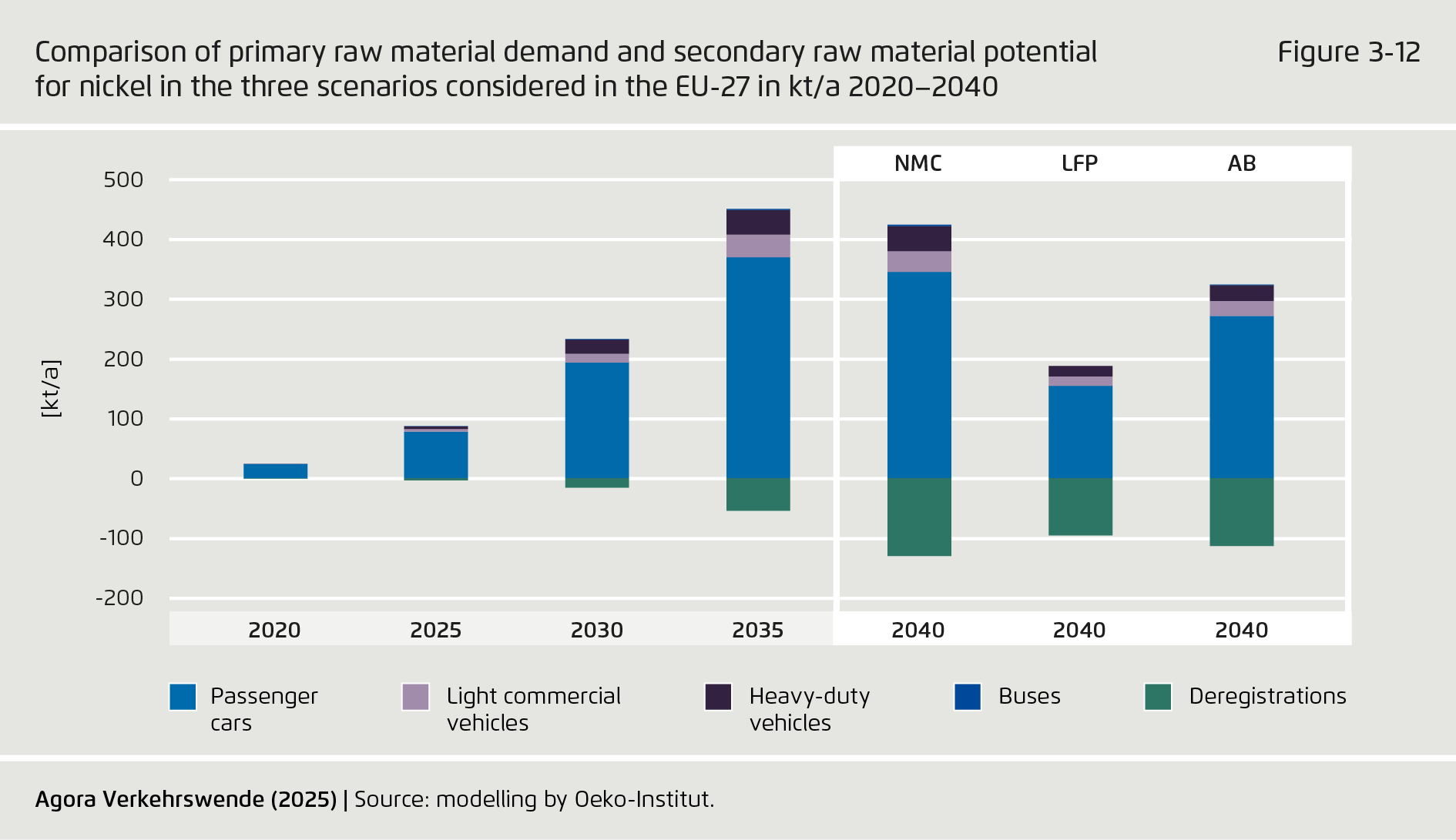

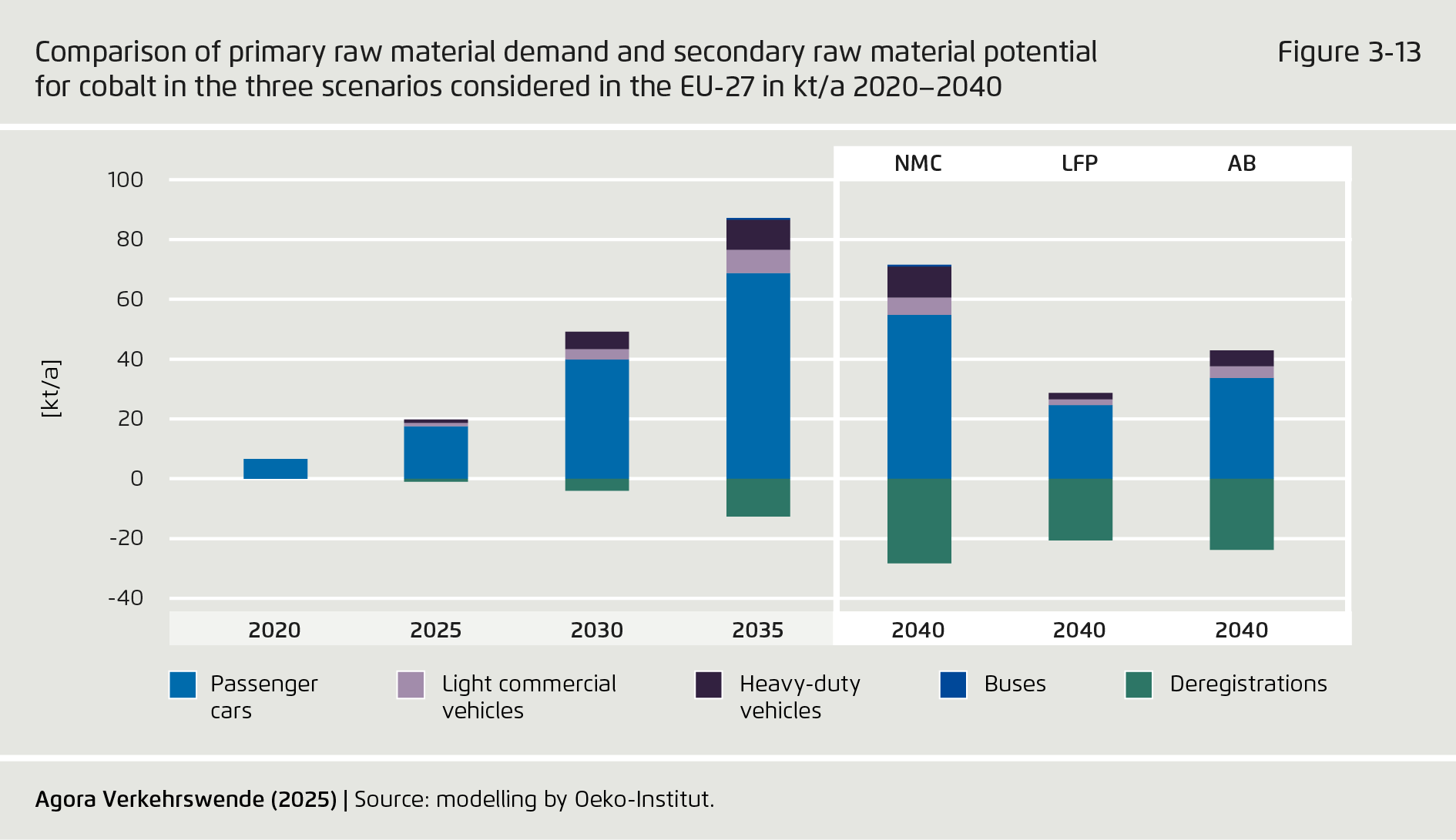

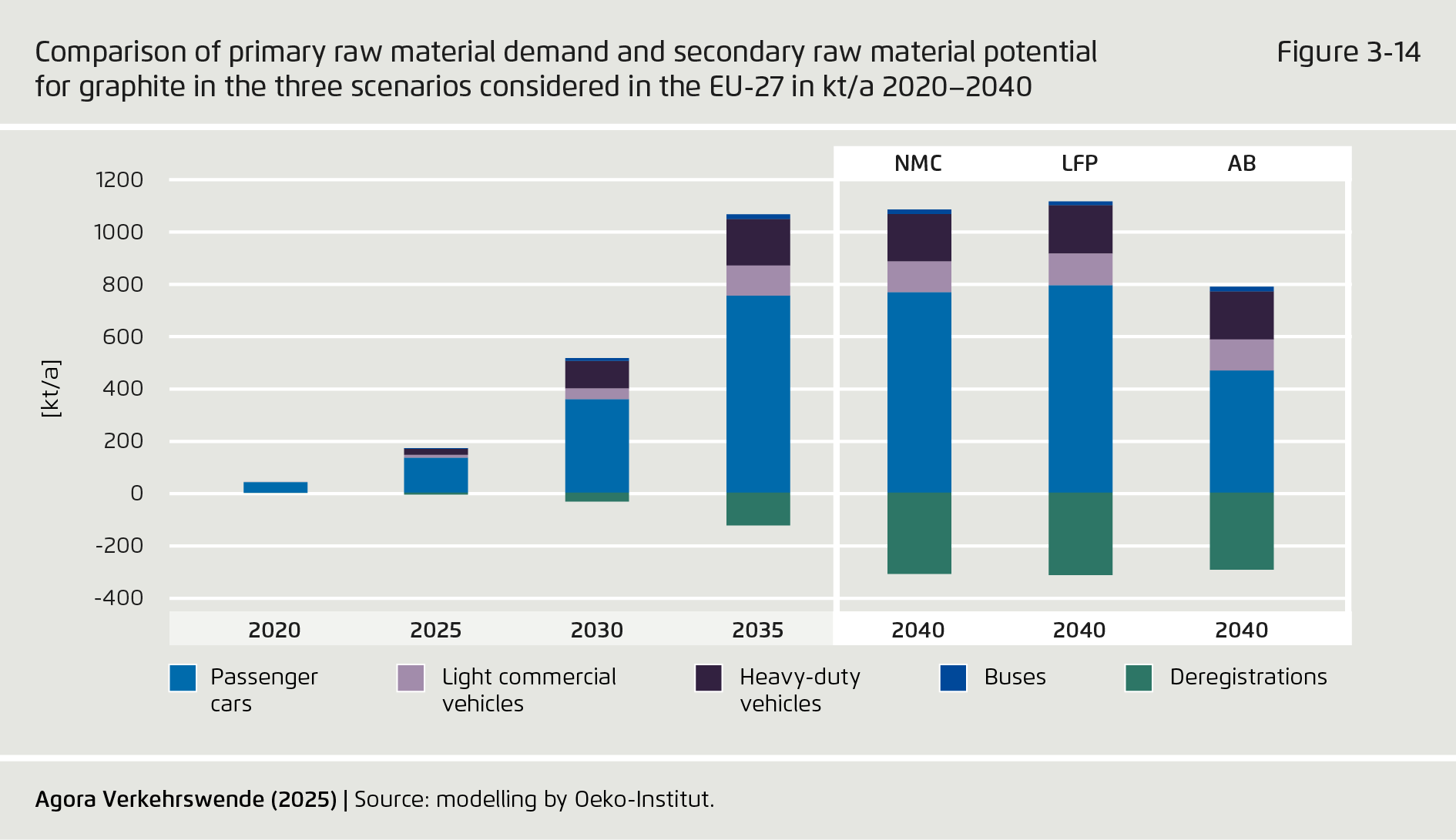

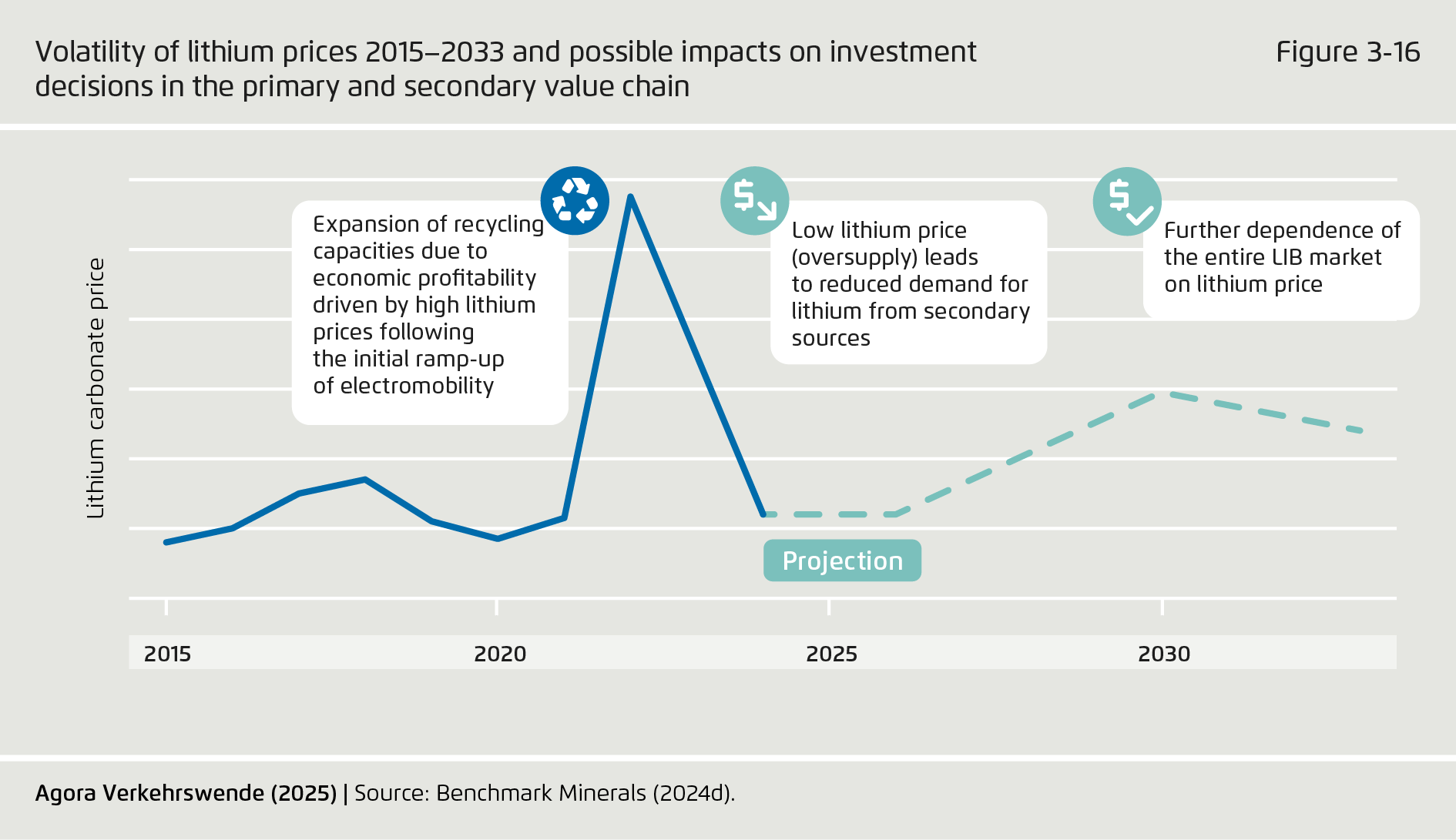

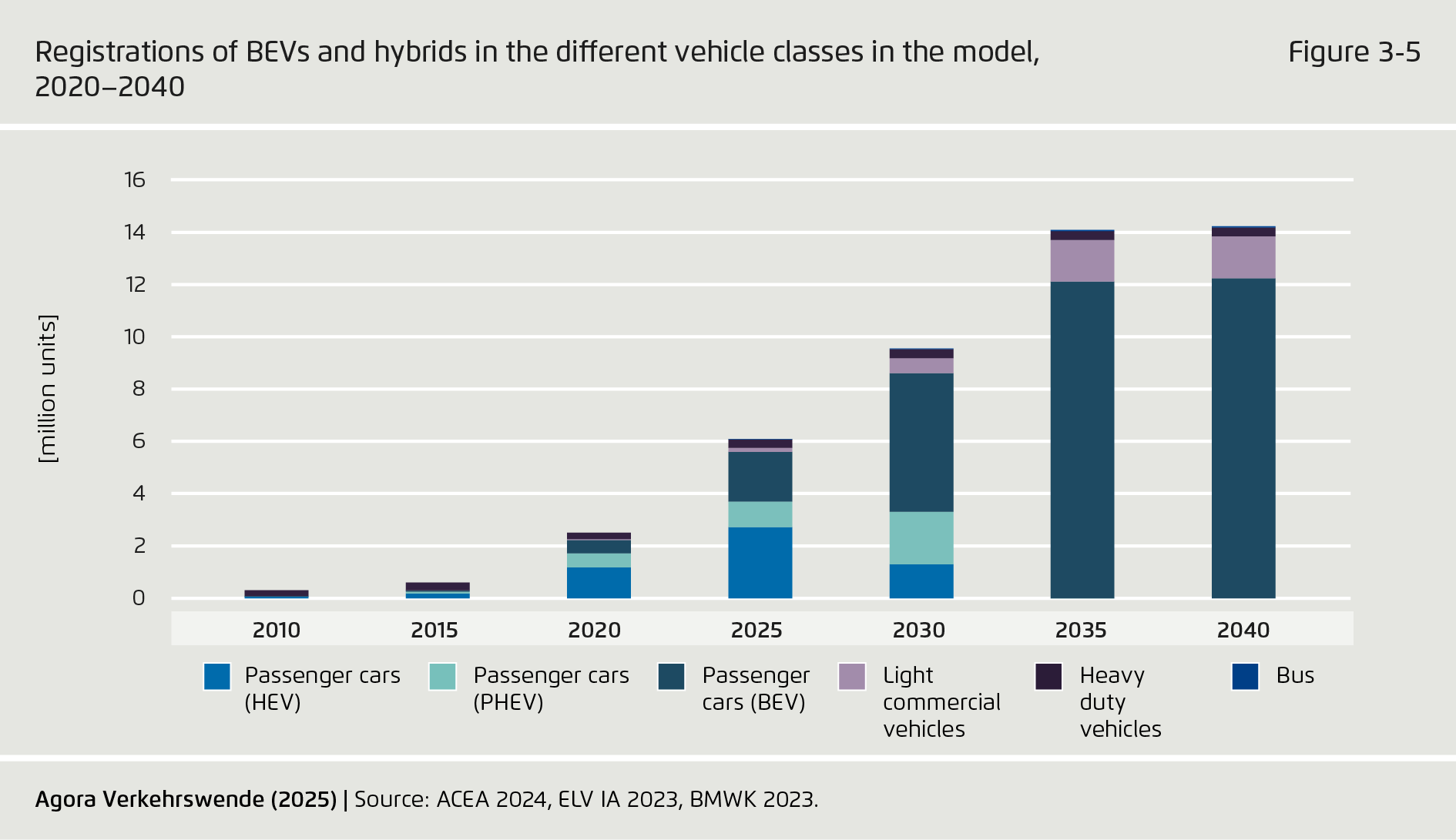

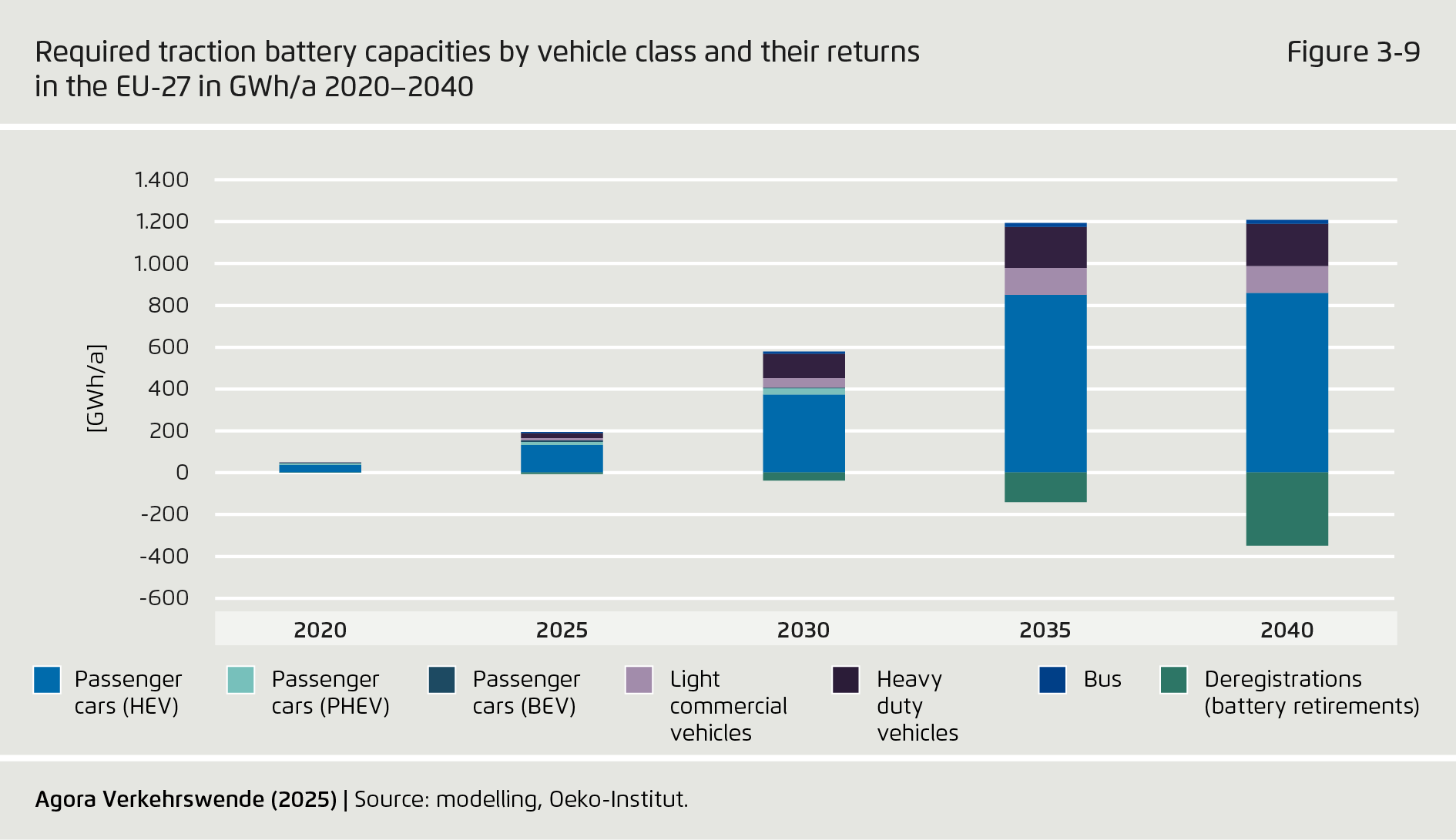

Over the next decade, demand for traction batteries in the EU is expected to increase sixfold — reaching a steady level of around 1,200 gigawatt hours per year. The growing volume of used traction batteries will provide valuable feedstock for the production of new ones. With efficient circular management, up to 25 percent of lithium demand could be met from recycled materials by 2040, and up to 50 percent of nickel demand. For cobalt, the potential share of secondary raw material exceeds 60 percent. Battery recycling is therefore not merely an issue of environmental or circular economy policy — it is also a matter of industrial and economic strategy.

-

The gaps in the EU’s raw material cycles for lithium-ion batteries remain substantial and must be closed without delay.

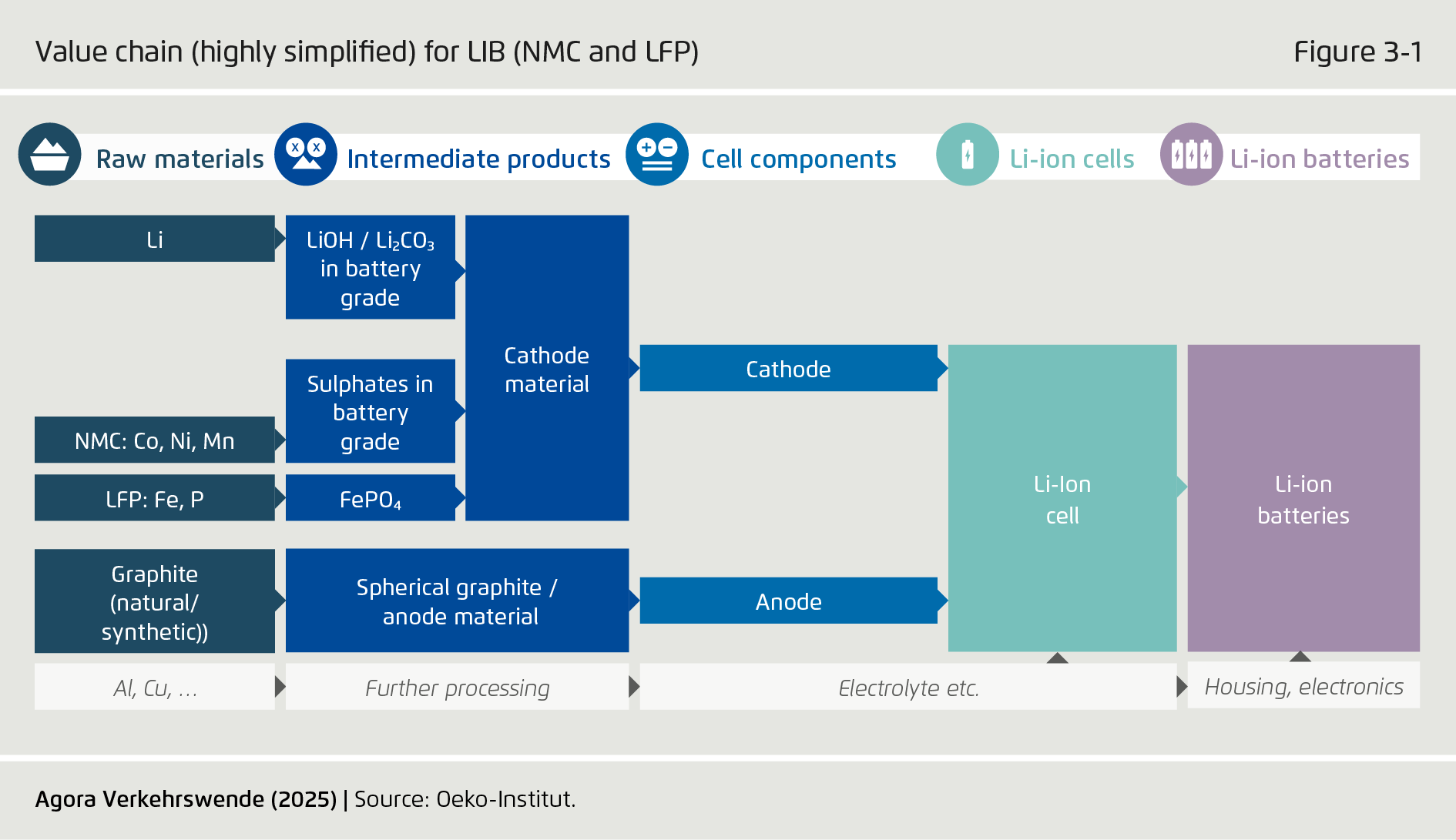

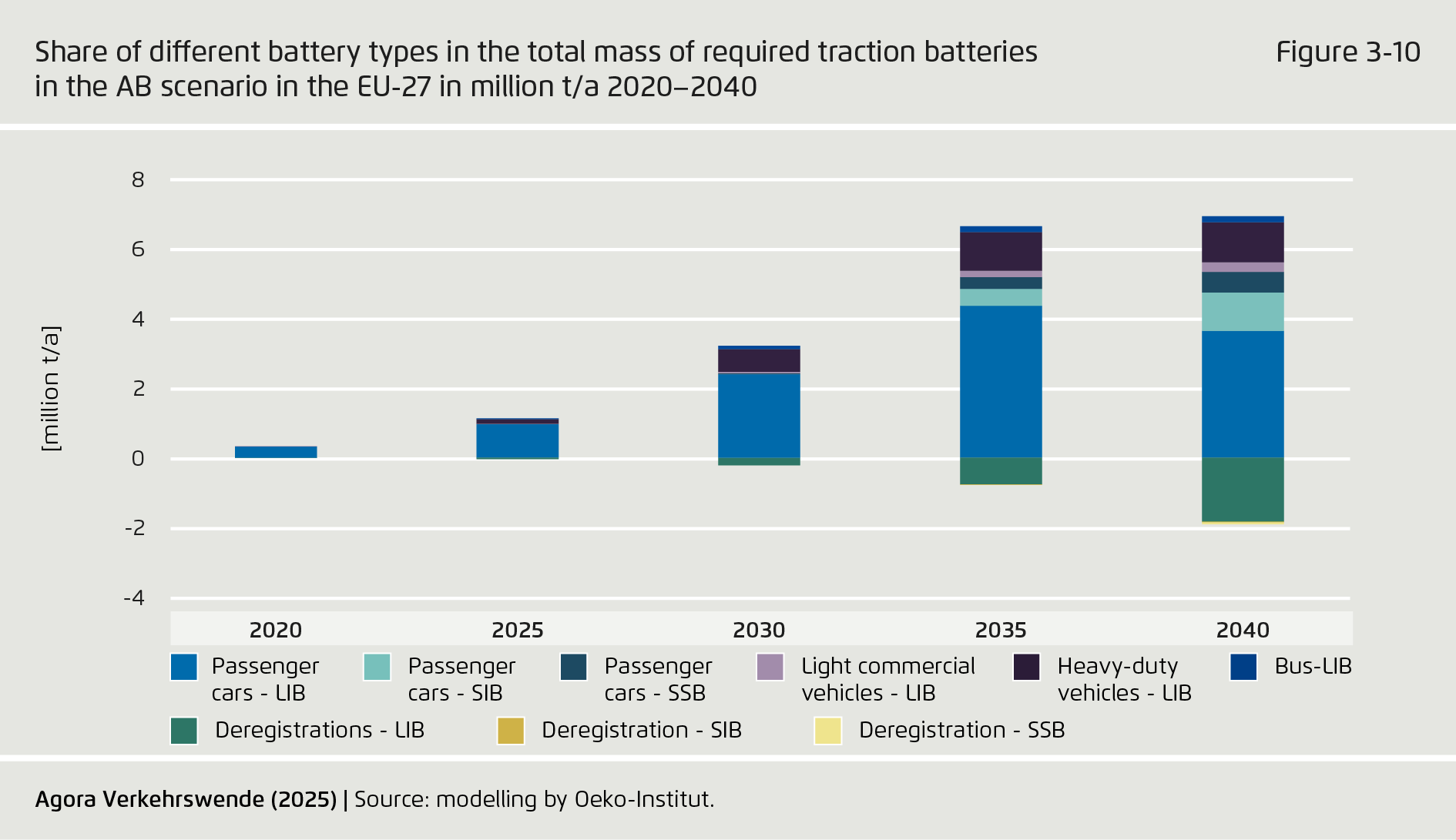

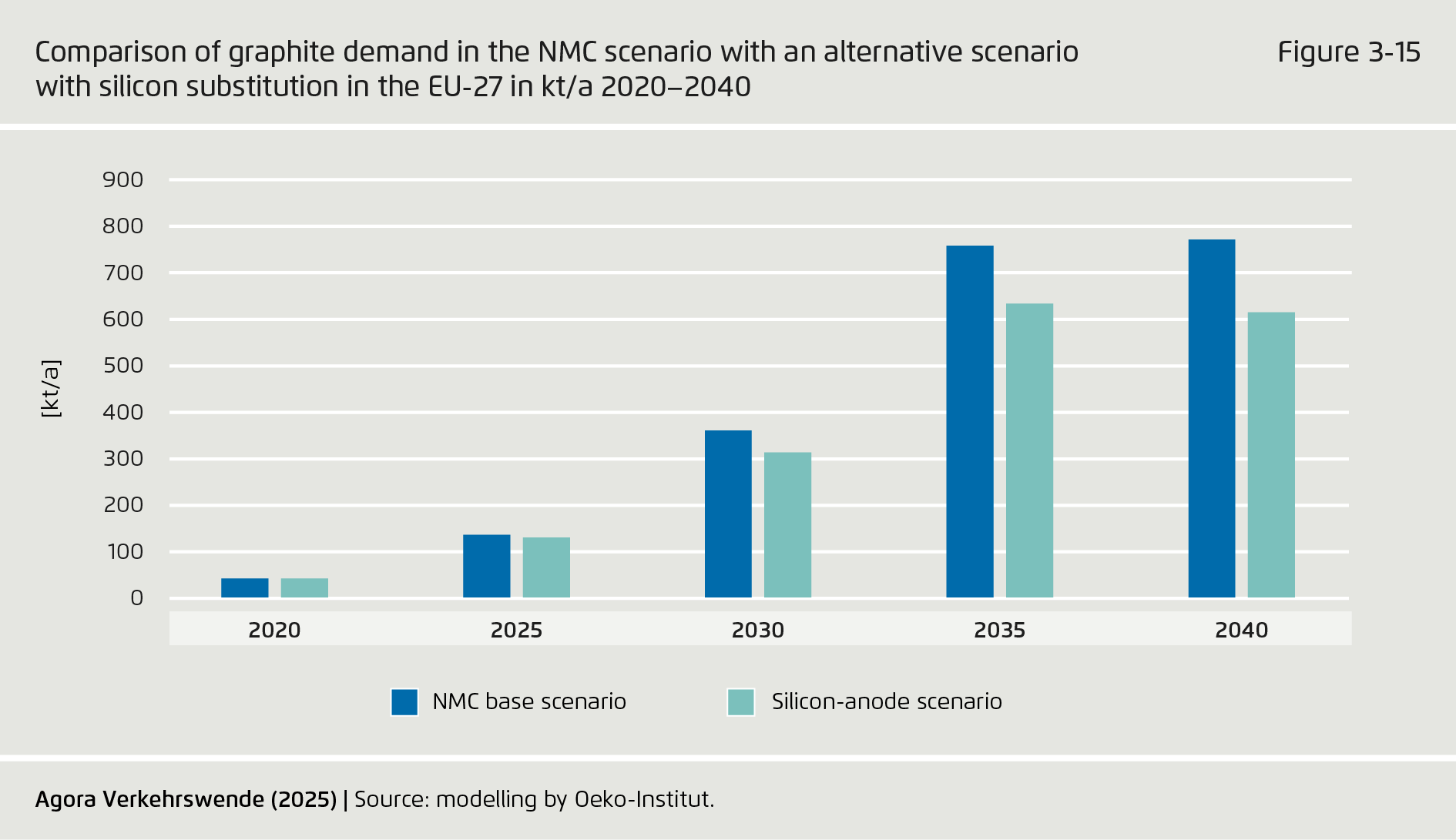

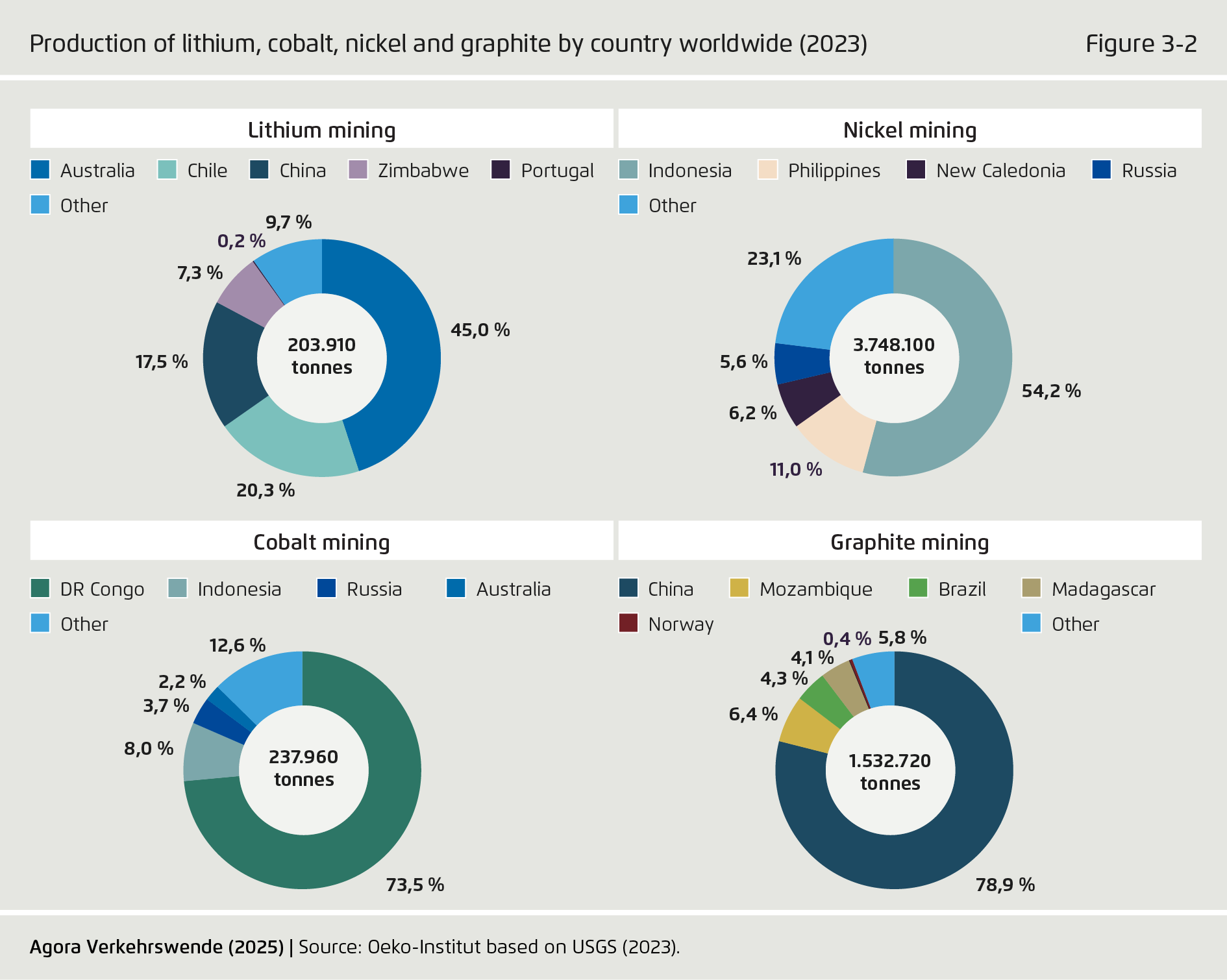

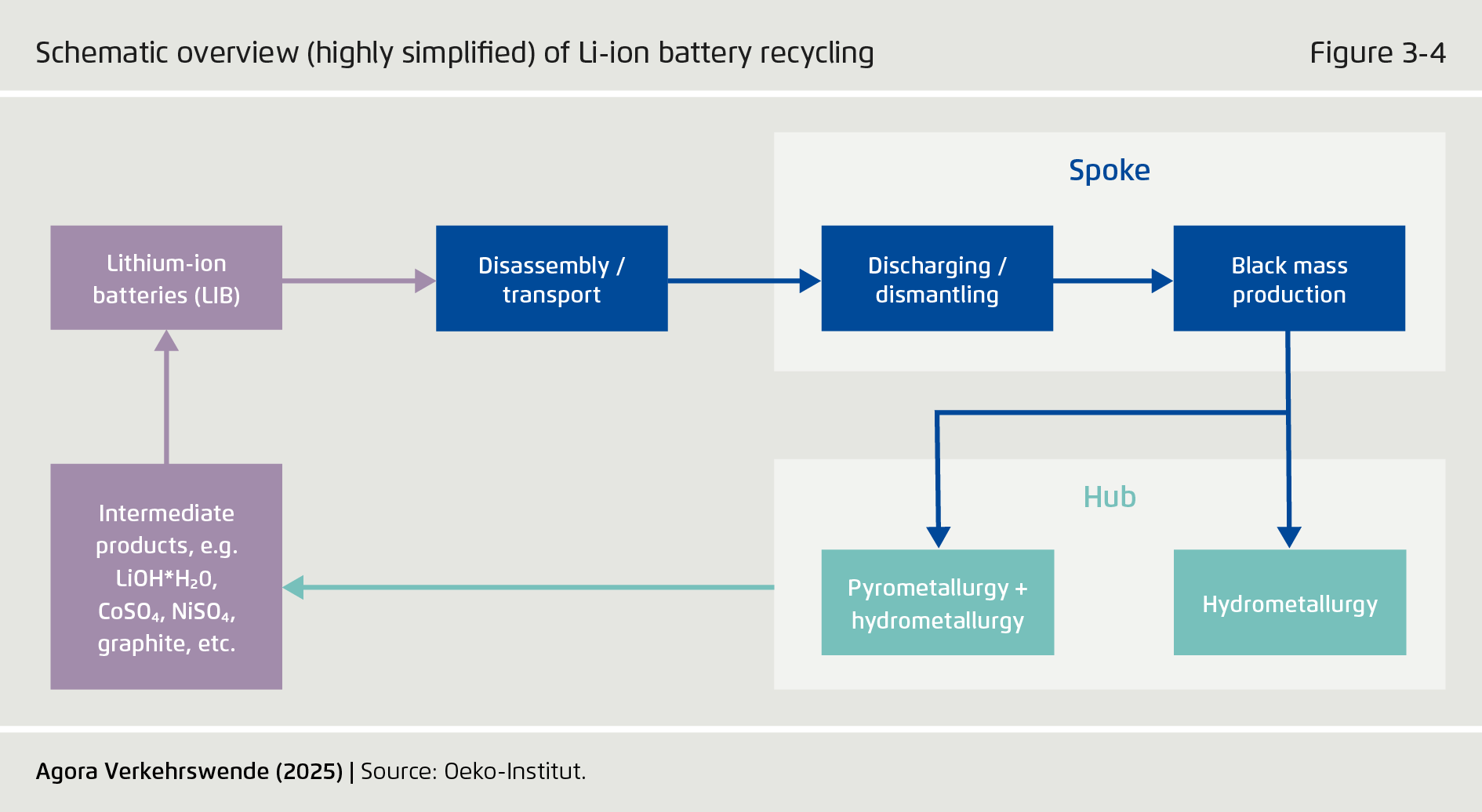

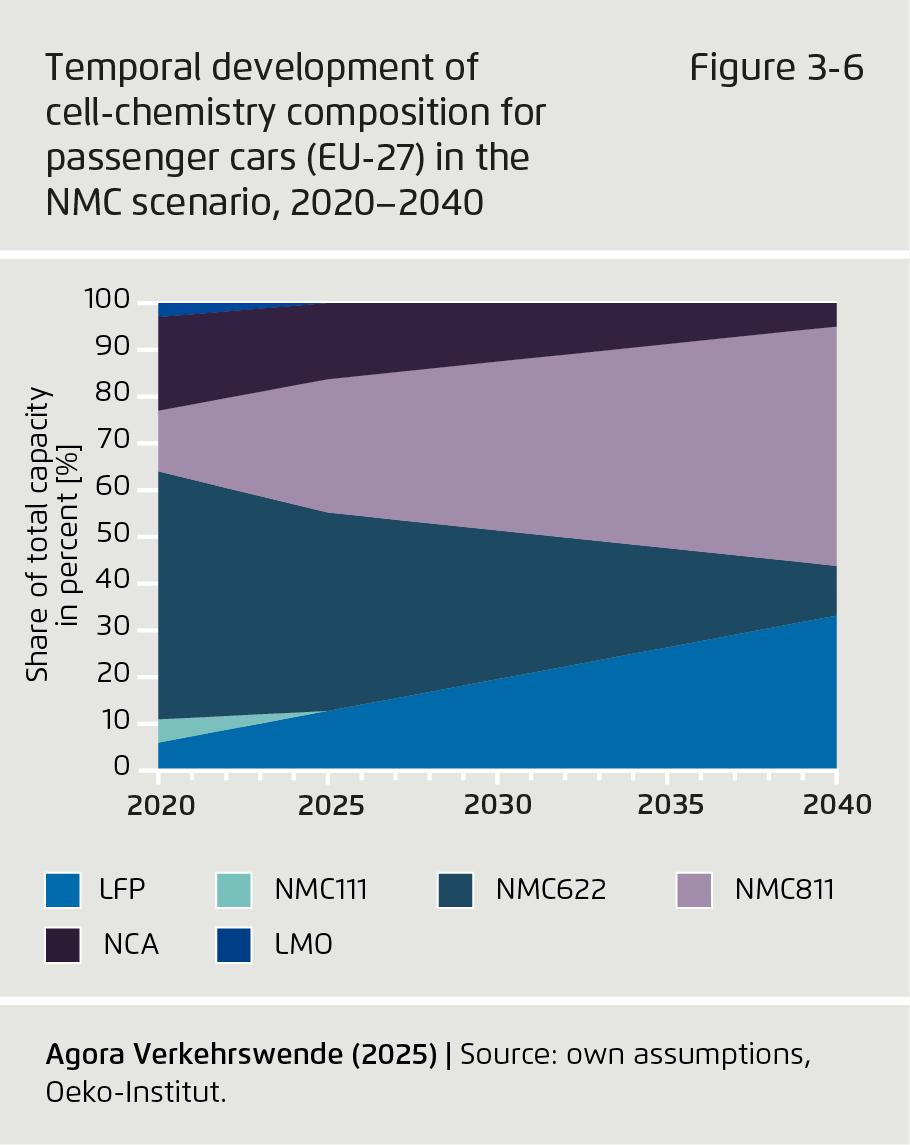

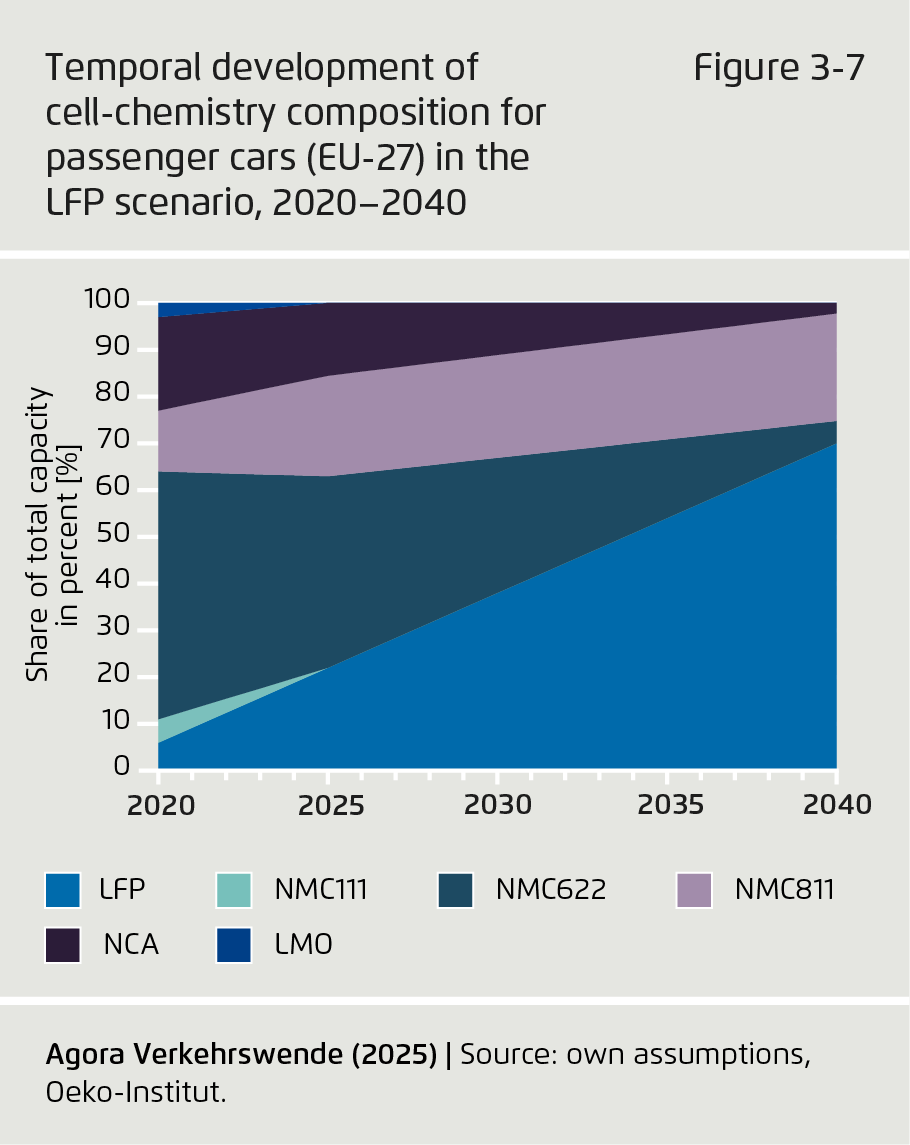

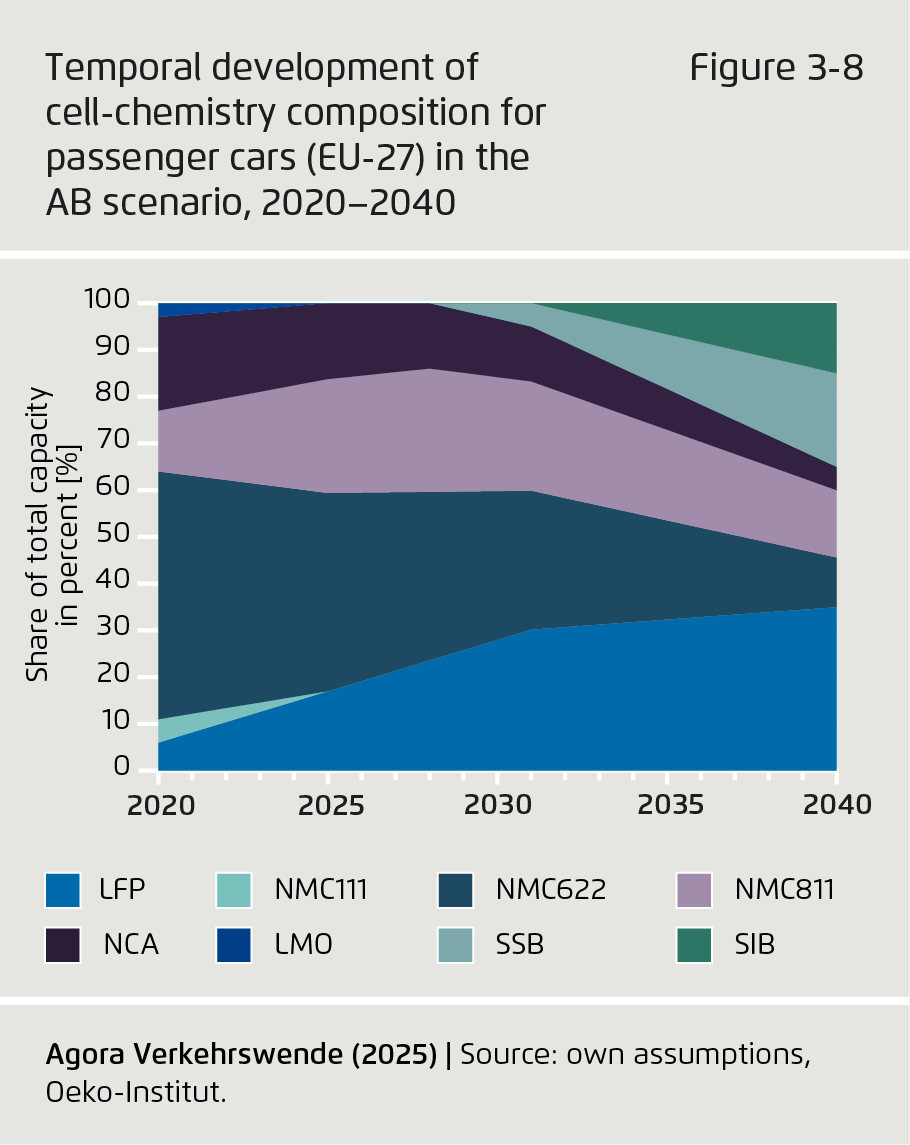

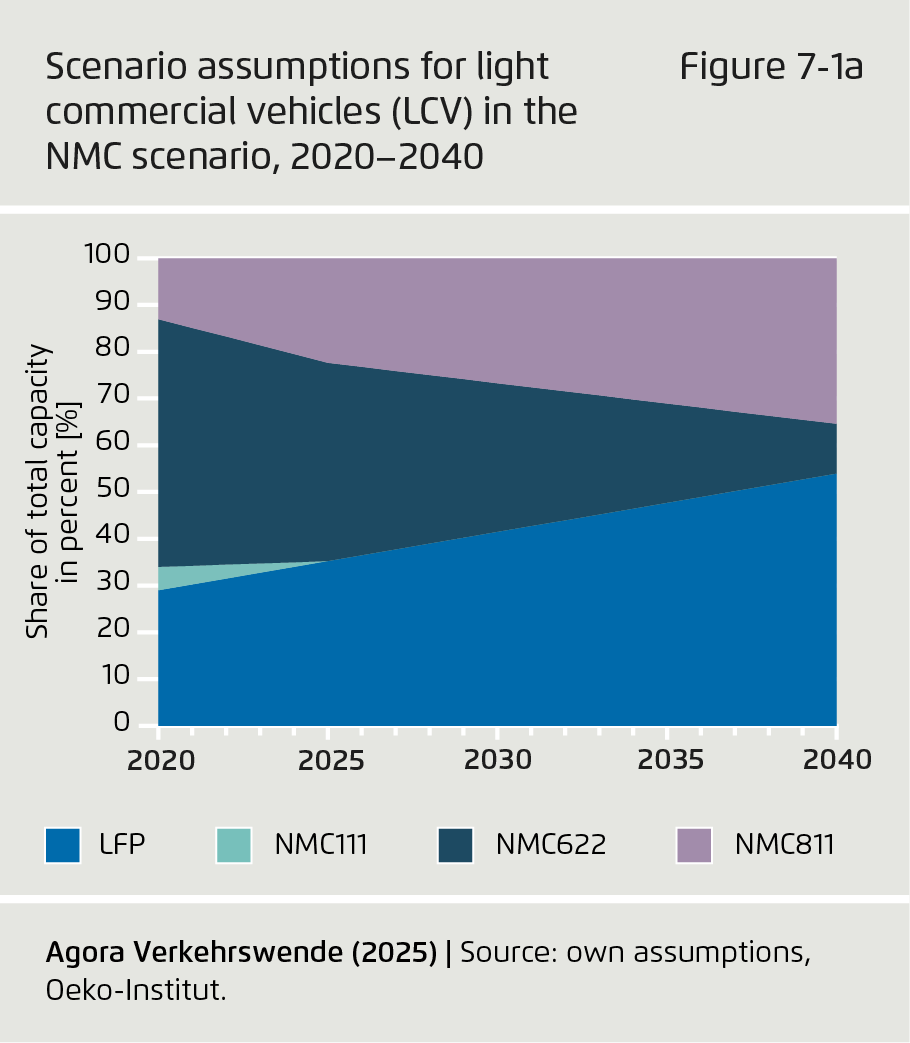

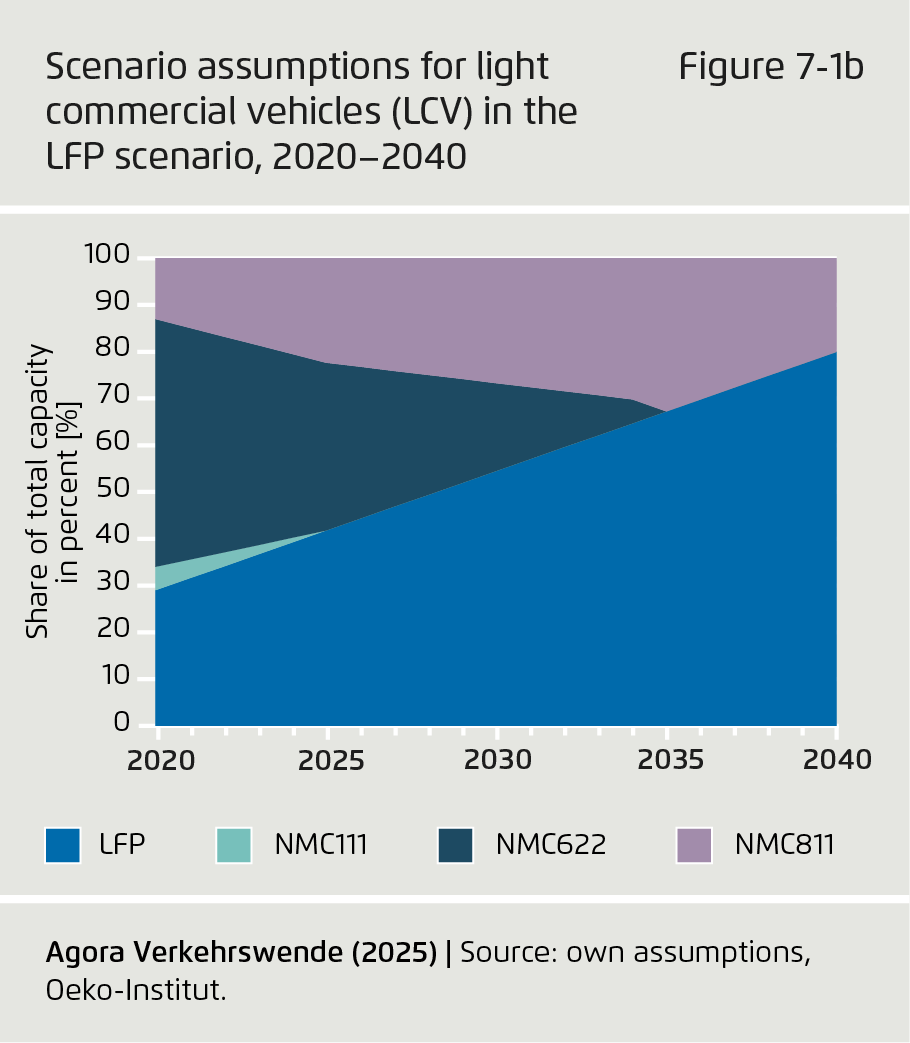

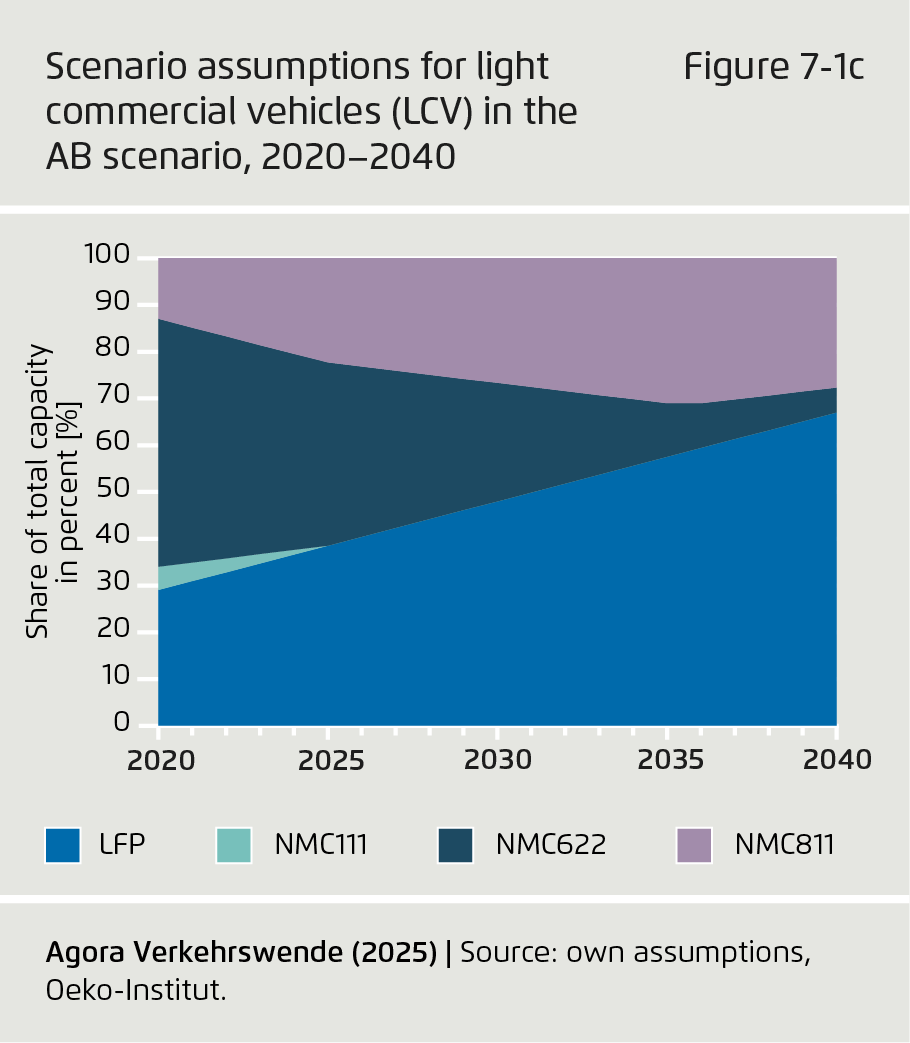

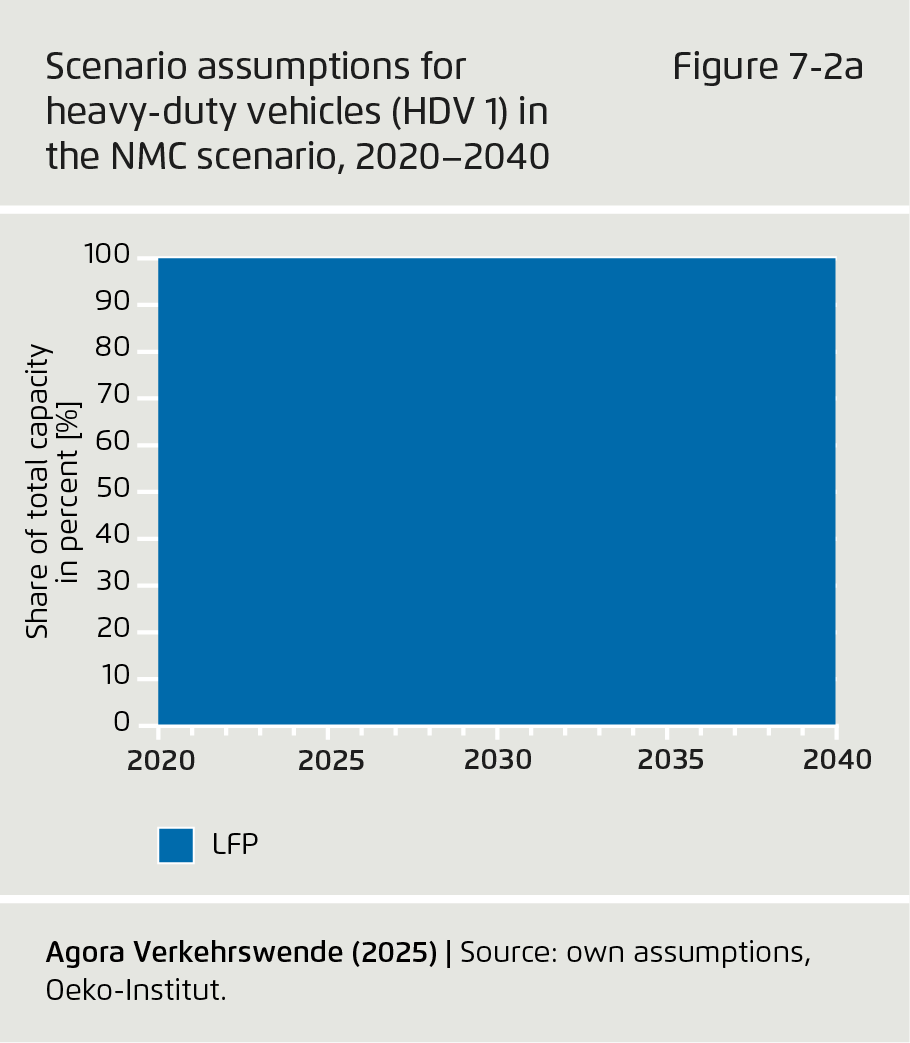

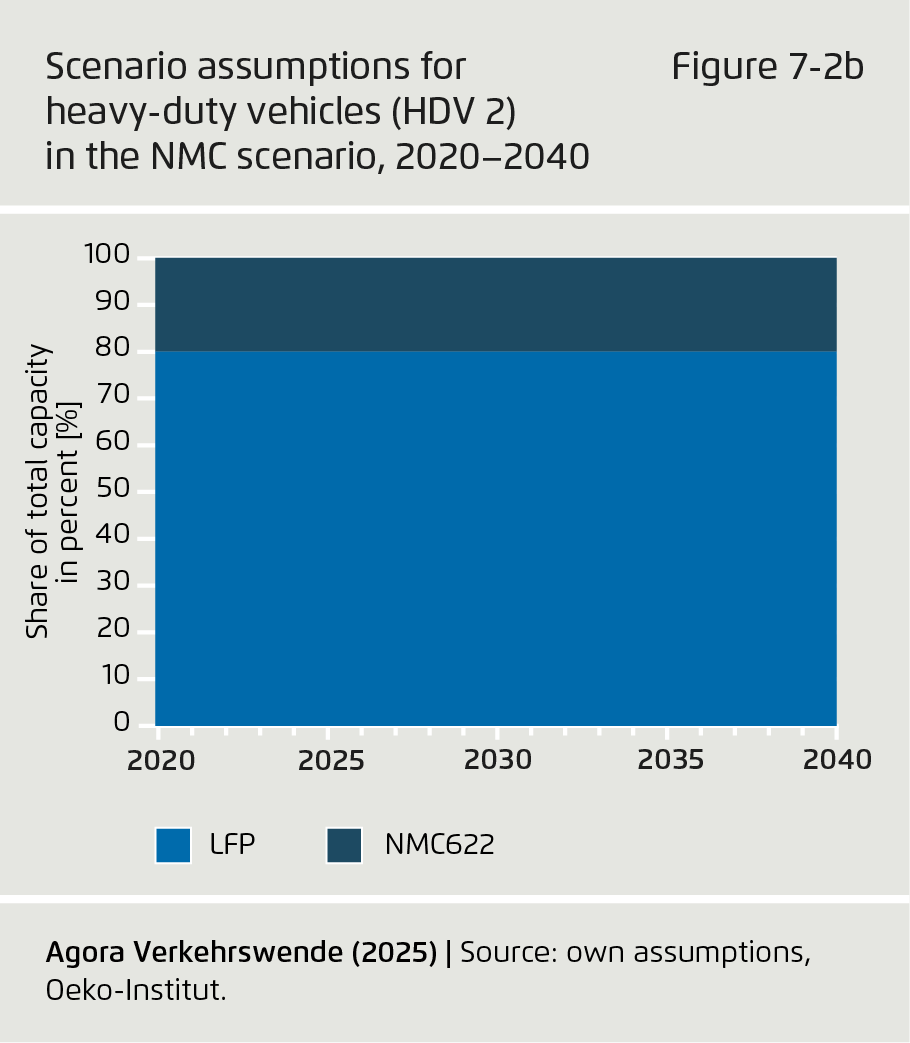

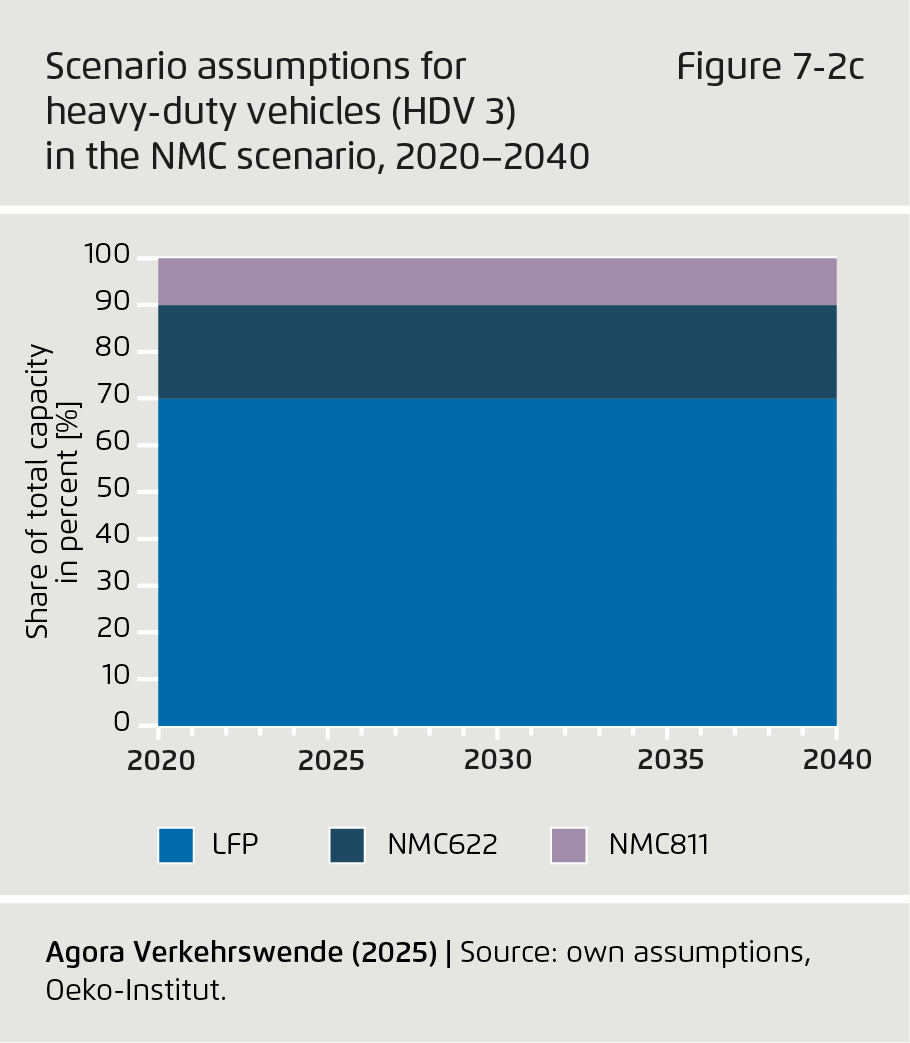

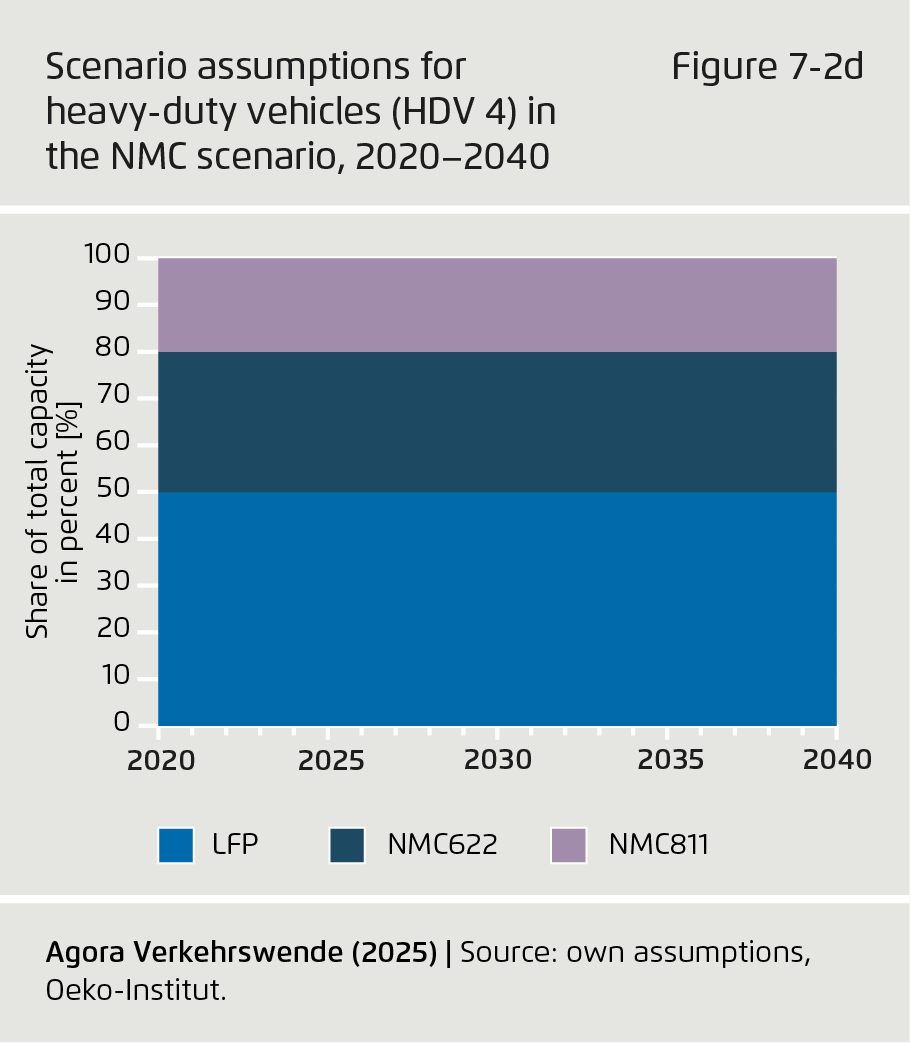

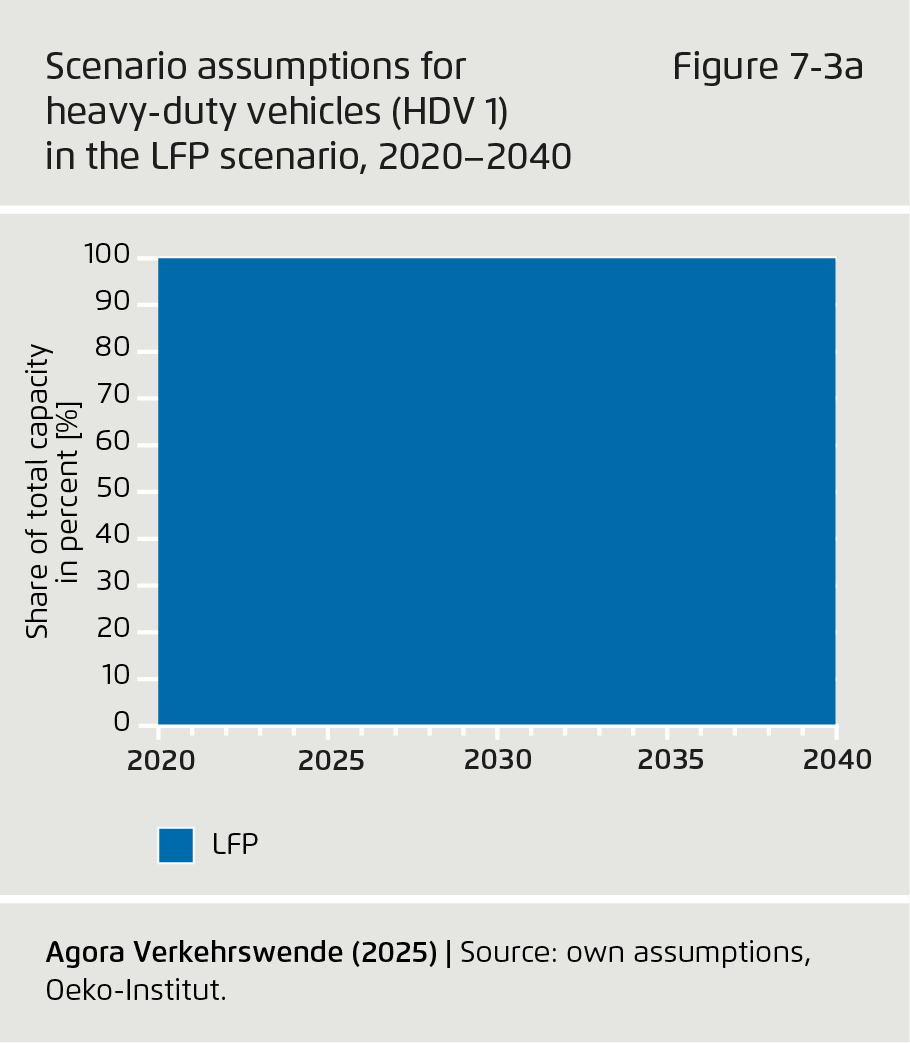

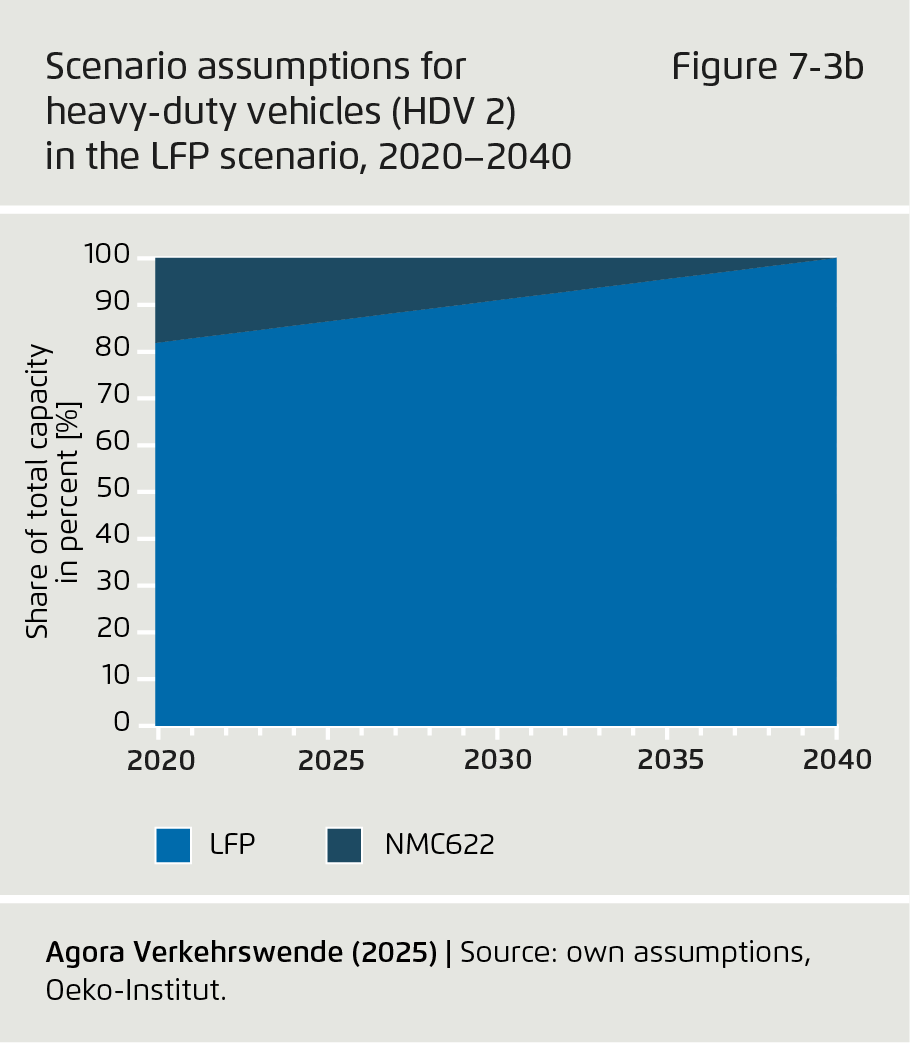

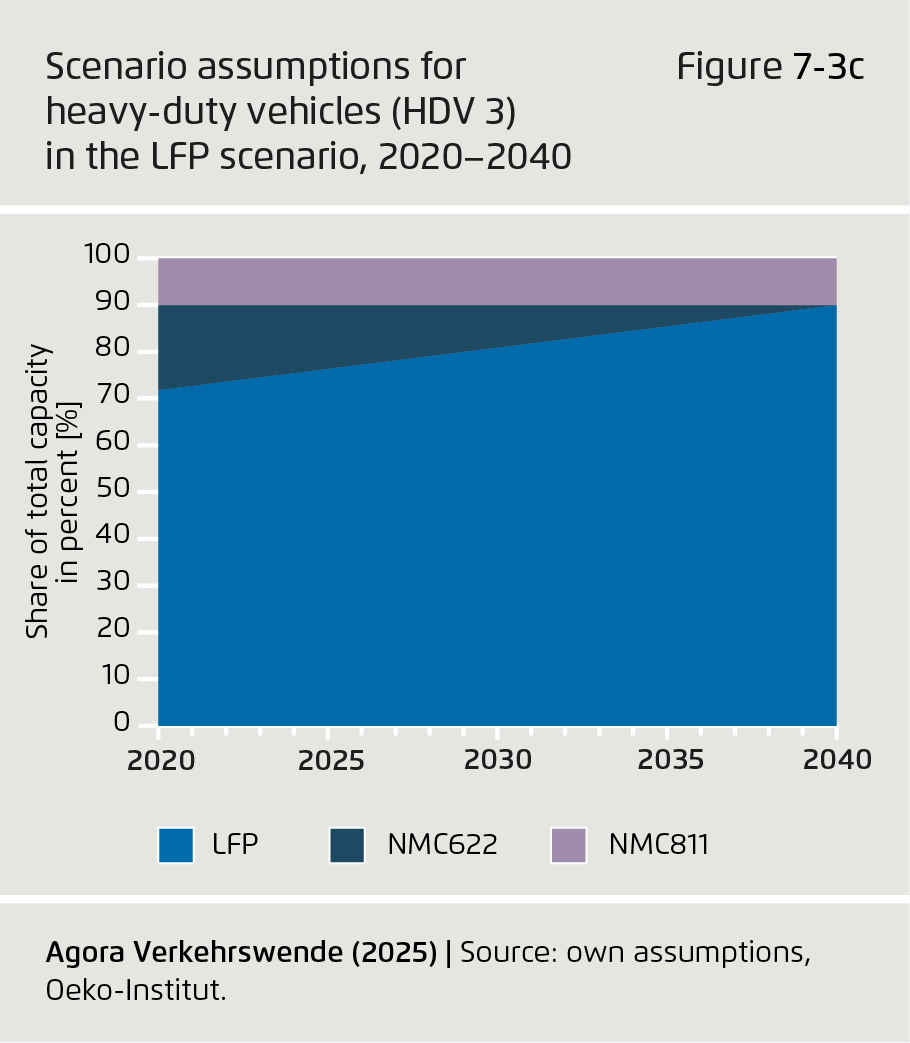

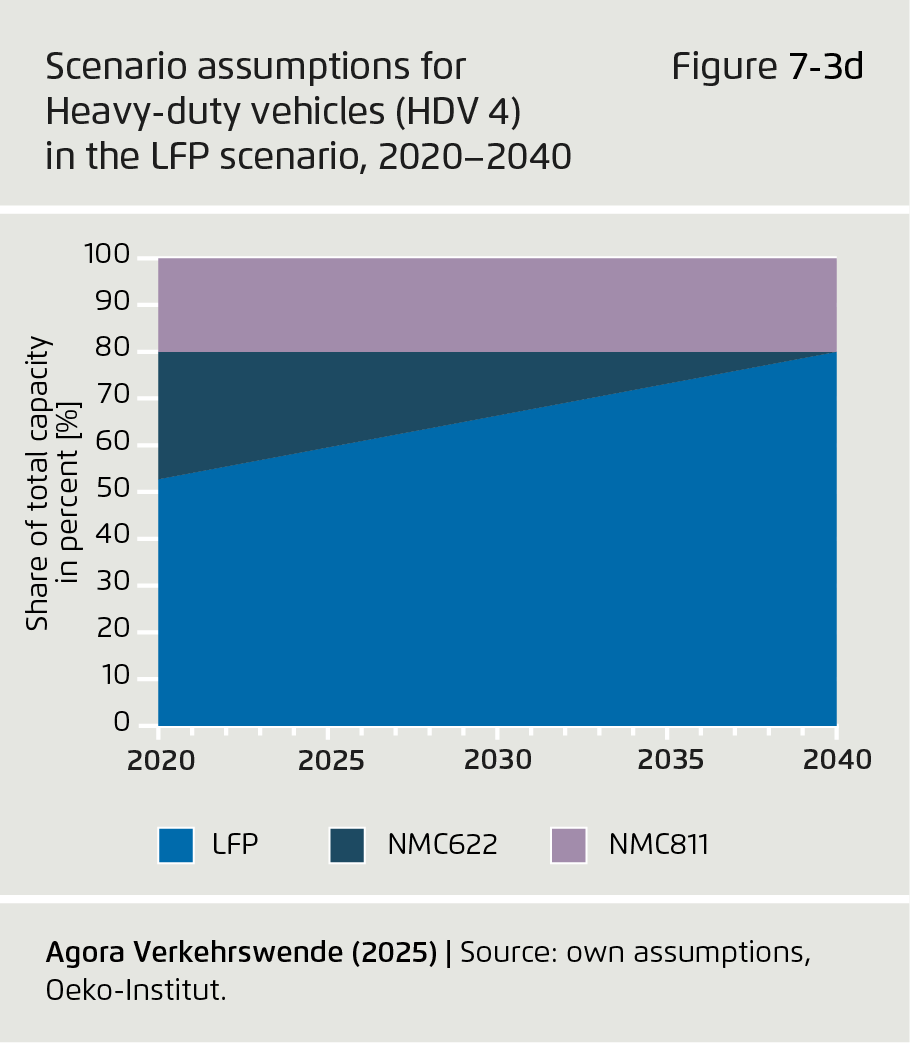

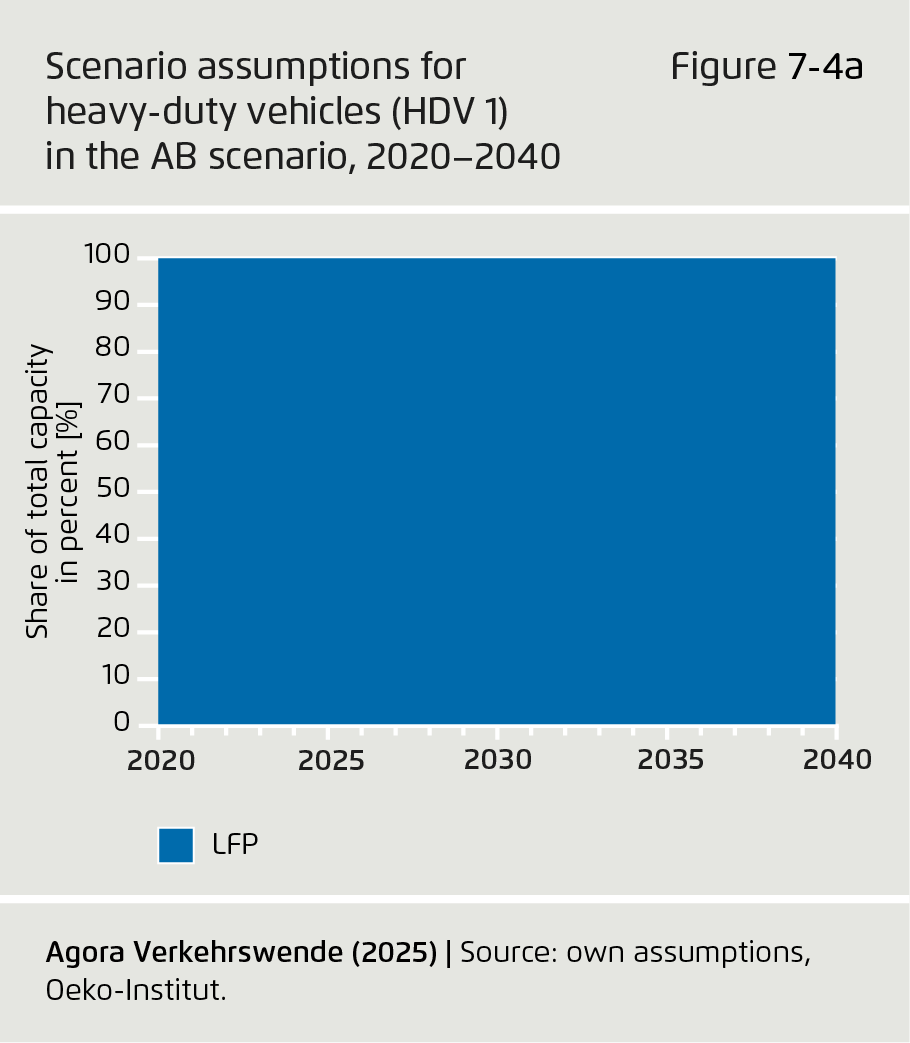

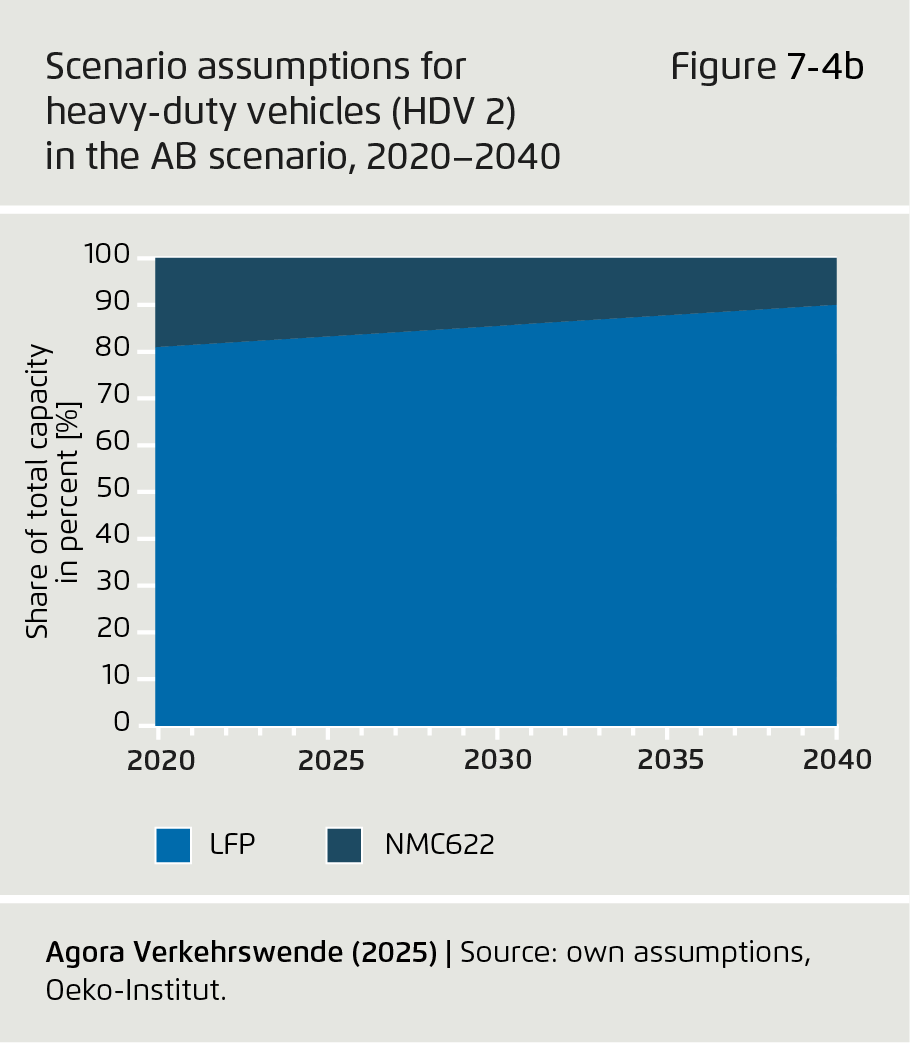

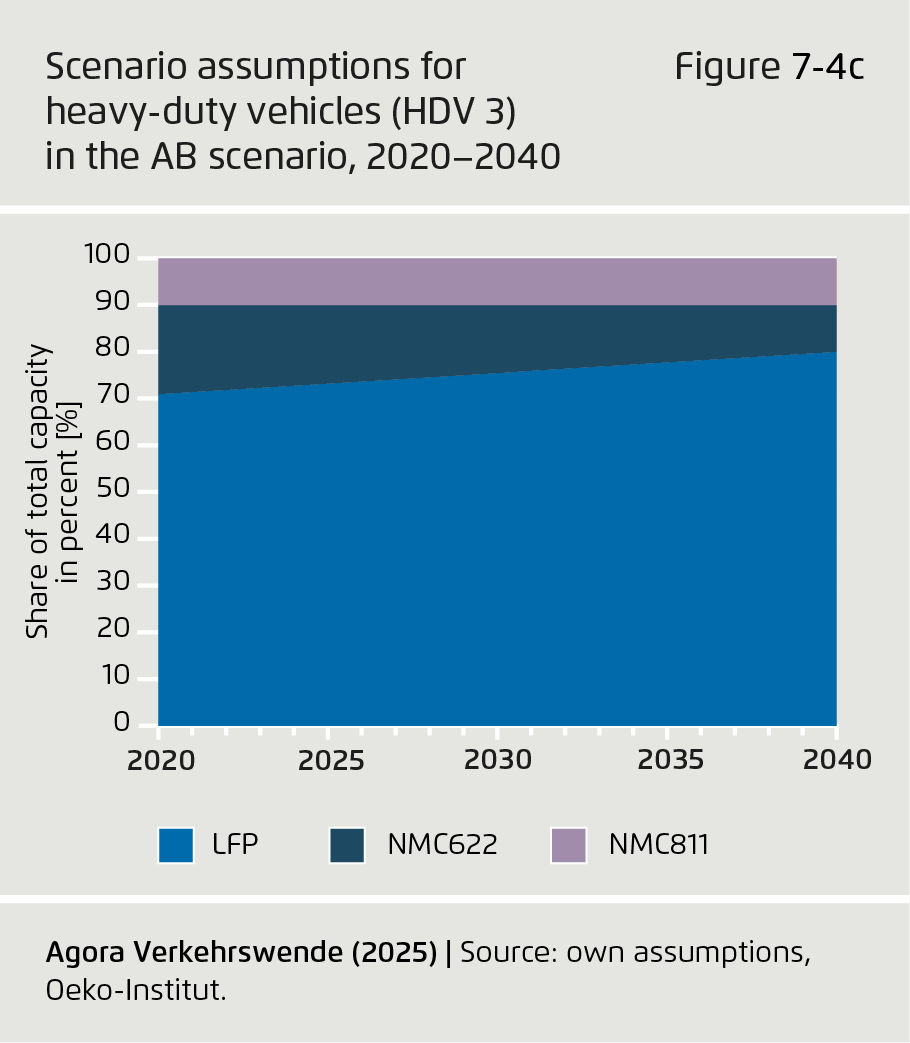

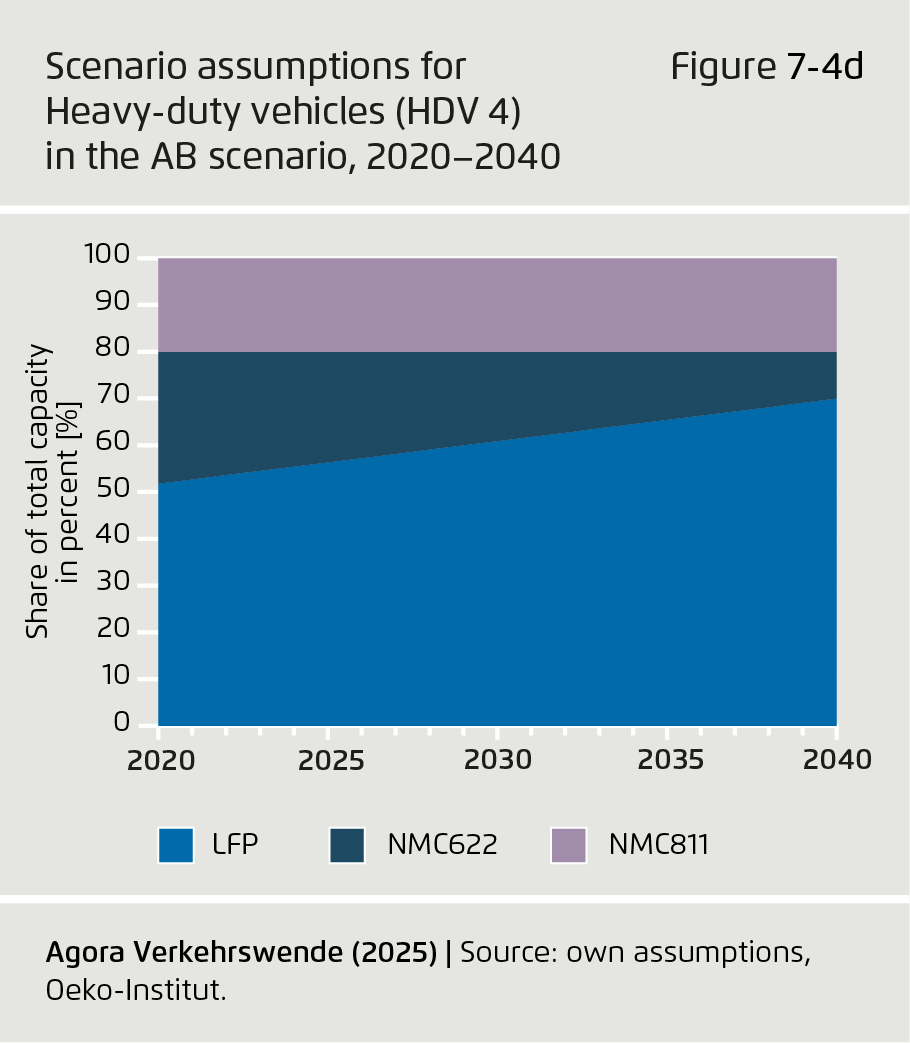

Action is needed at many points along the value chain: in raw material extraction, cathode and anode material production, cell manufacturing, and the recycling of black mass to recover battery materials — thereby securing battery-grade feedstock from European sources. Demand for key raw materials is set to rise significantly by 2035, while the chemical composition of traction batteries continues to evolve. A clear trend can already be seen toward lithium-ion batteries using lithium-iron-phosphate cathodes, which require no nickel or cobalt.

-

Through the implementation of the Critical Raw Materials Act, the EU is continuously supporting the establishment of closed material cycles for traction batteries and adjusting its approach as needed.

This includes robust measures to strengthen the recycling industry across the entire value chain and to prevent the outflow of intermediate products — such as black mass or recovered raw materials — to non-EU countries. At the same time, market participants will find it difficult to meet their legal obligations if sufficient capacity for the recovery and processing of recycled materials is not available within the EU. Accordingly, the EU should maintain close monitoring of these material cycles and roll out its policy measures incrementally over time.

-

The EU aims to further harmonise recycling systems for traction batteries across Member States in order to achieve economies of scale and improve cost efficiency.

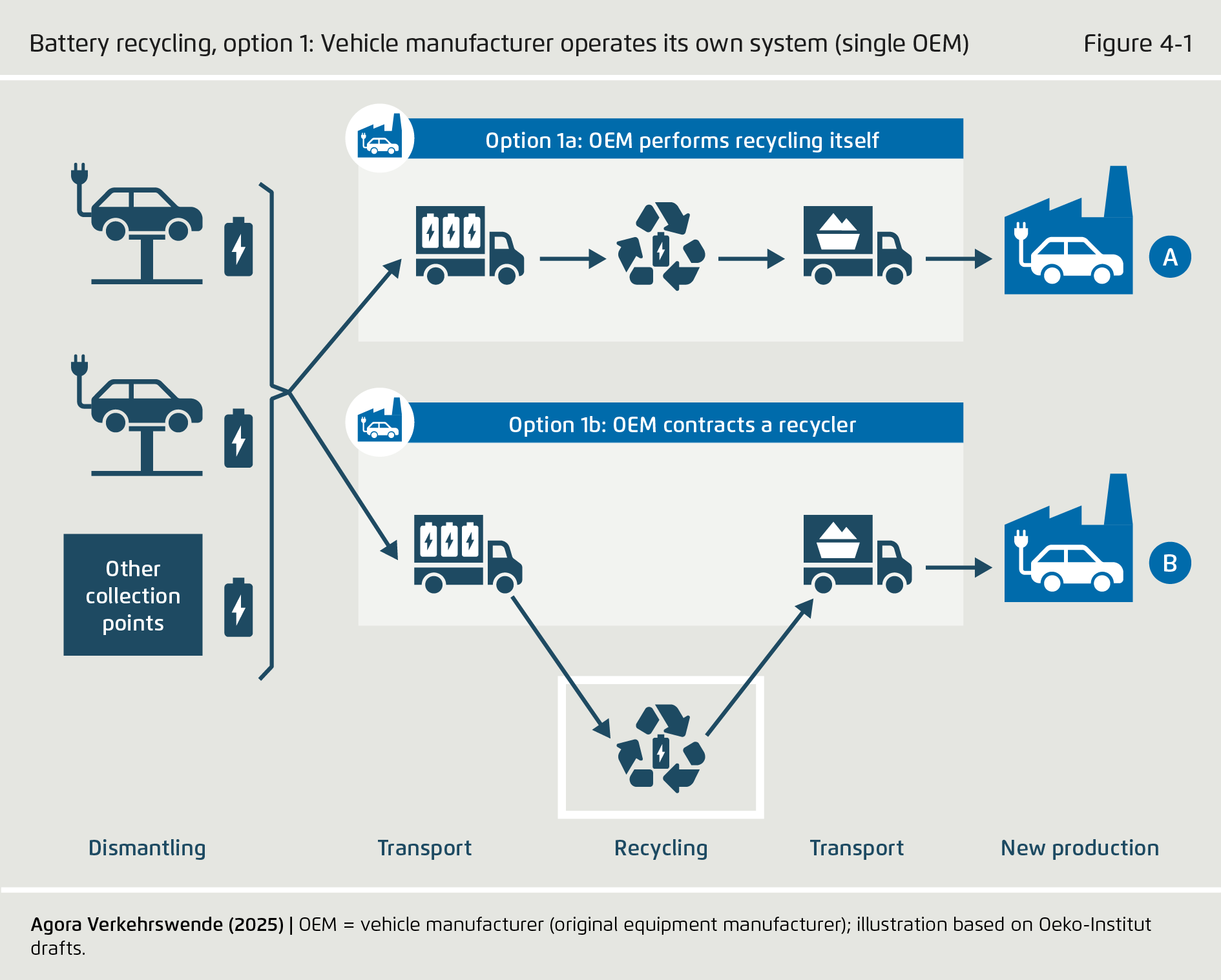

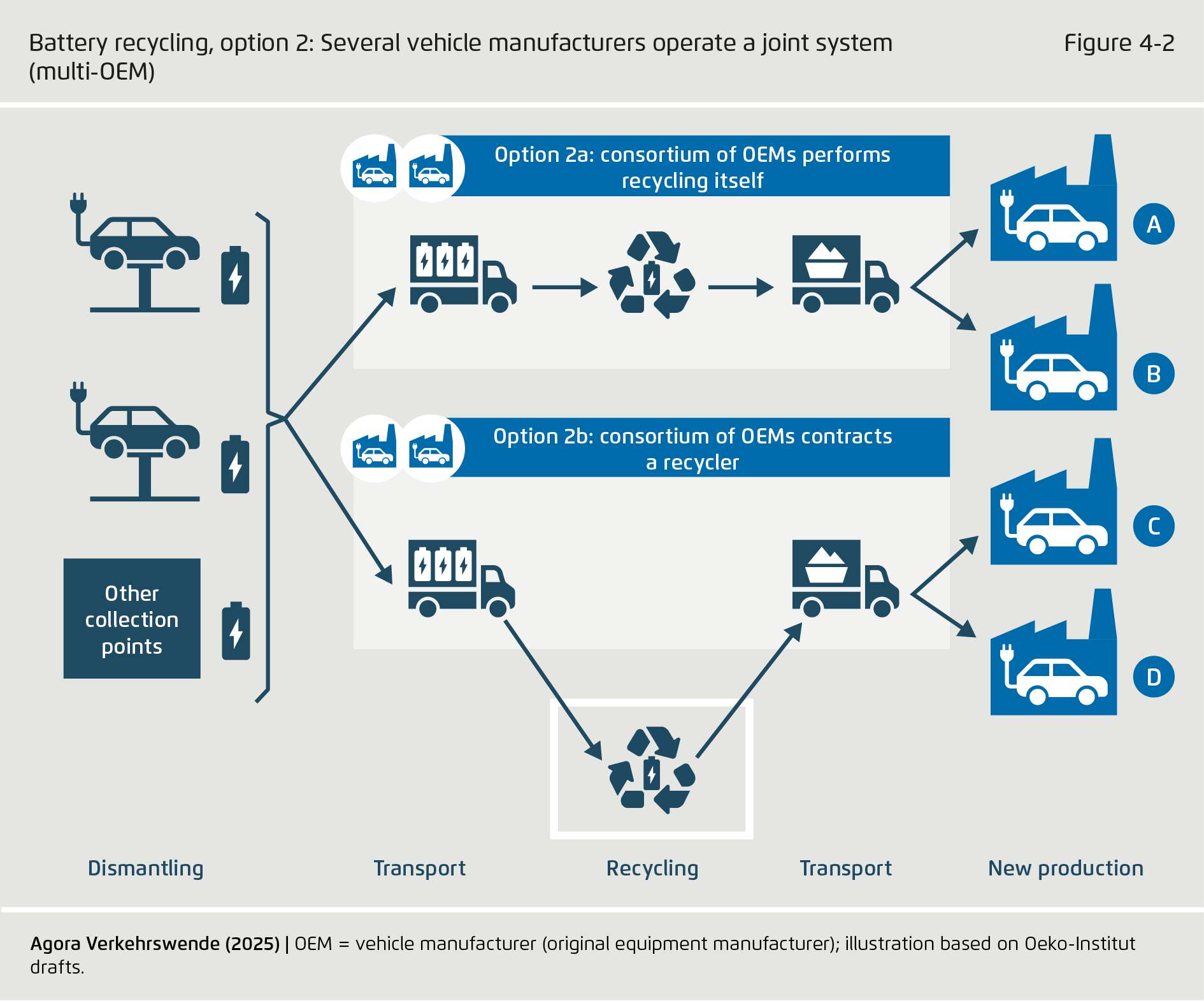

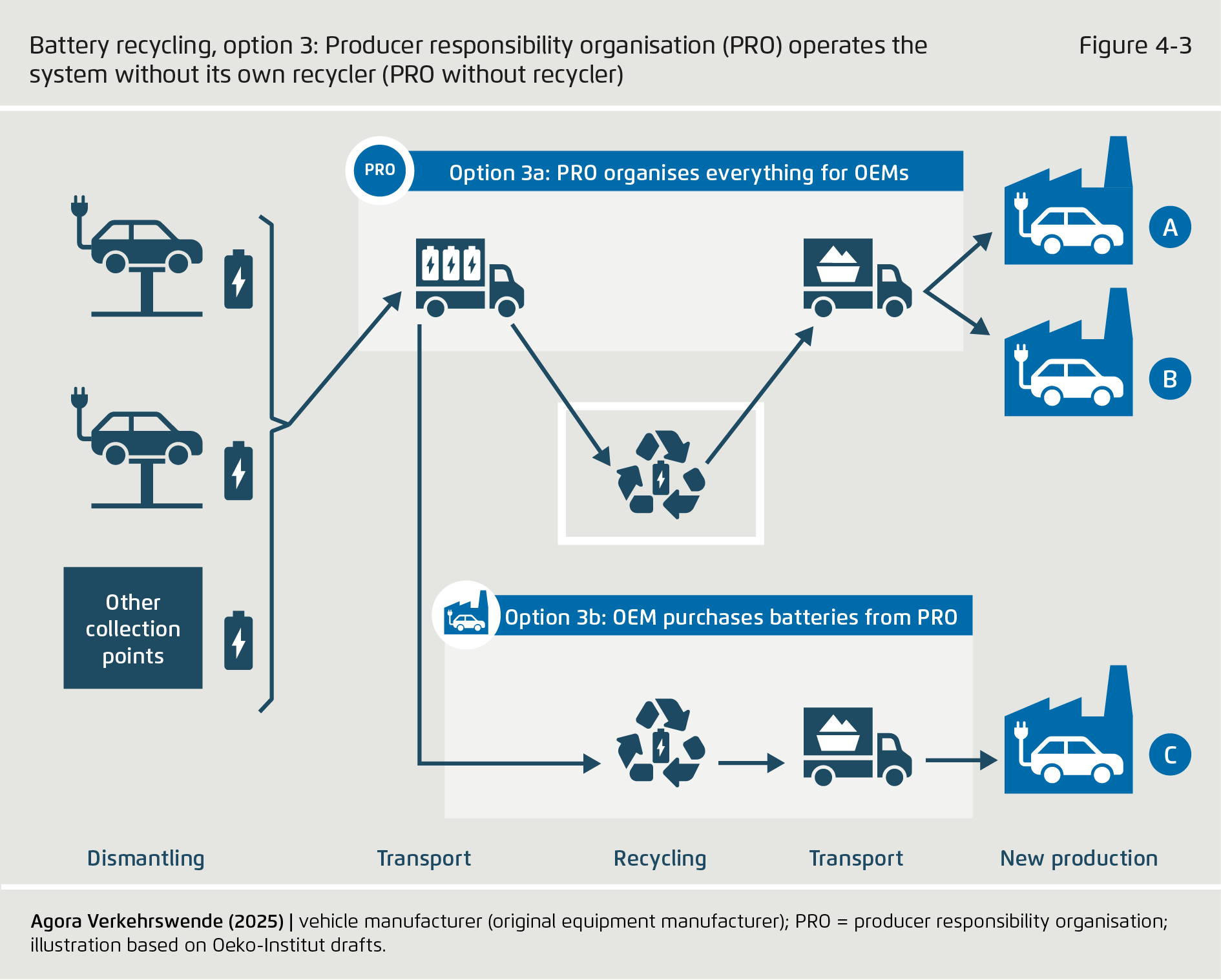

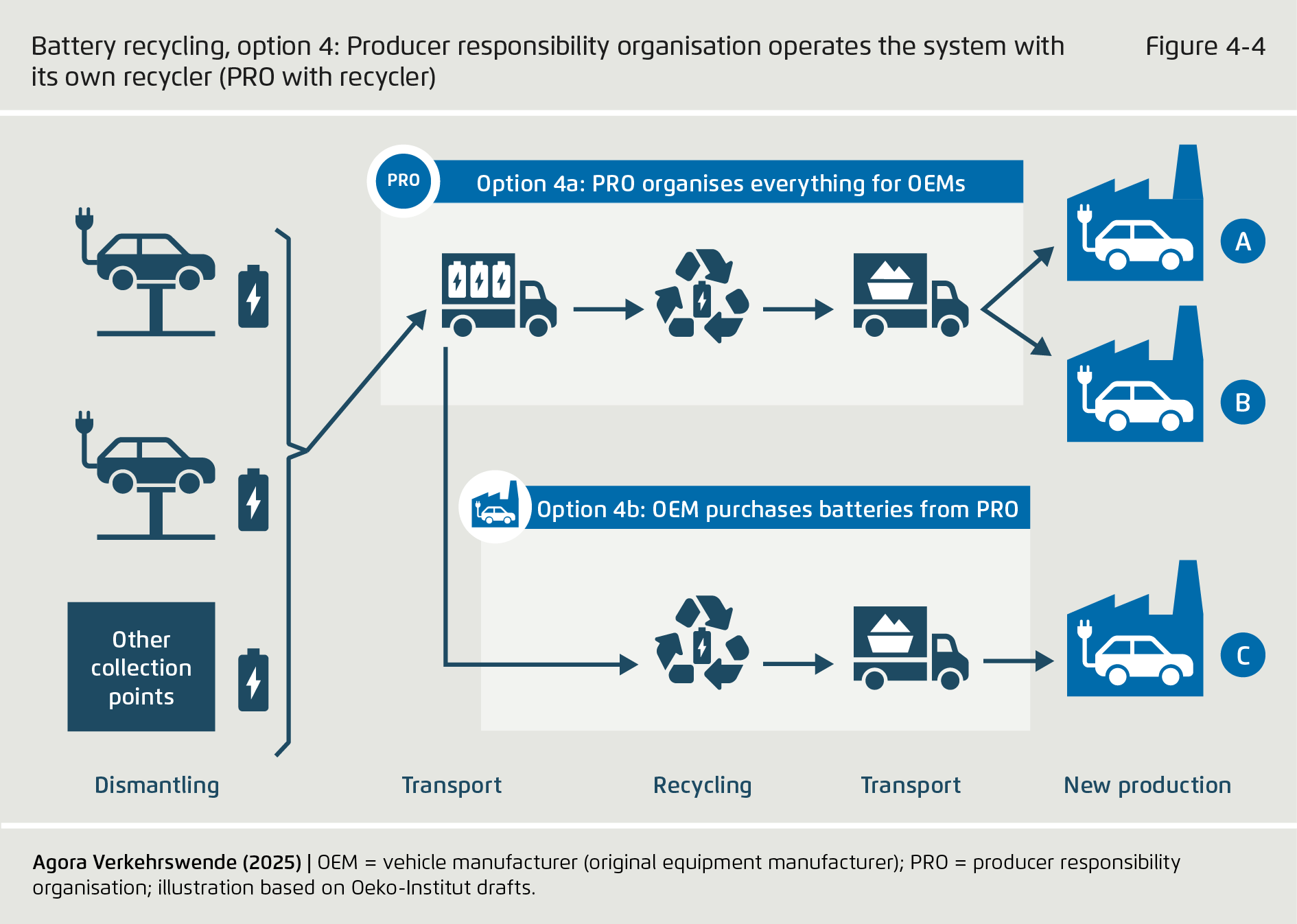

Under the current Battery Regulation, various business models are possible. Vehicle manufacturers may organise take-back schemes independently or appoint a producer responsibility organisation to manage them. However, the legal frameworks differ from one Member State to another. All recycling-system models are capable of meeting ambitious environmental and social standards. Nonetheless, the greatest economies of scale can be achieved when large volumes of batteries from different manufacturers are processed under uniform conditions.

-

The EU, Member States, vehicle manufacturers, and producer responsibility organisations are working together to address the remaining challenges.

Some of the pressing questions for traction-battery recycling in the EU include: How realistic is it to keep all vehicles produced in the EU within the Union until the end of their service life? What potential lies in cross-border cooperation — possibly extending to non-European markets? How can recycling systems for traction batteries be made future-proof, given that ongoing technological change, such as in battery chemistry, is fundamentally reshaping business models? Answering these questions will require close and sustained dialogue across the entire value chain.

This content is also available in: German

Material Cycles for Traction Batteries

Raw material potential of battery recycling in the automotive industry and options for meeting extended producer responsibility in Europe

Preface

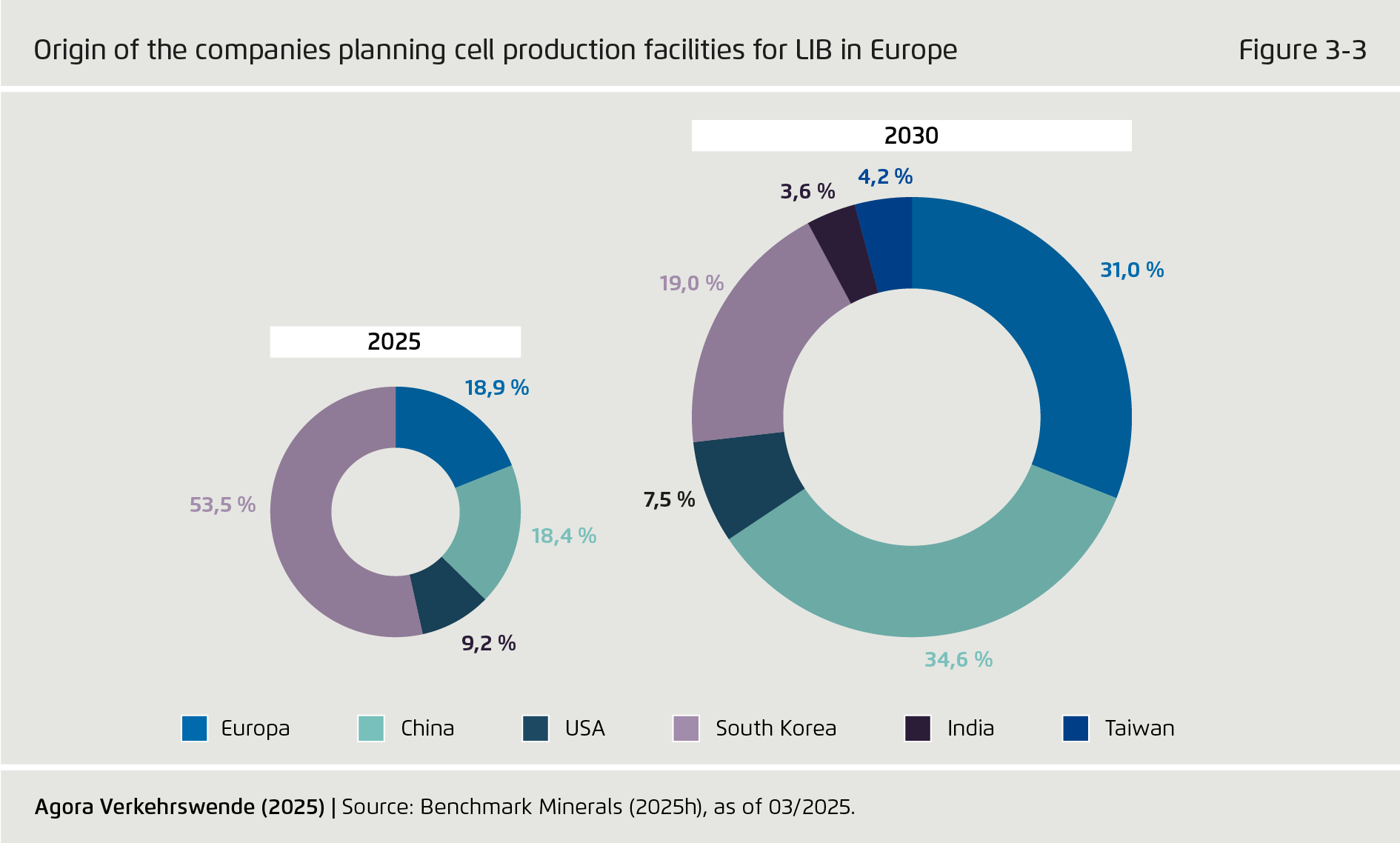

The industrial transformation toward climate neutrality is well under way. New technologies and products rely on raw materials and value chains that differ fundamentally from those of the past. In the automotive industry, this primarily concerns raw materials and intermediate products used to manufacture traction batteries for electric vehicles — in particular lithium, cobalt, nickel, and graphite. Global competition for access to primary production of these materials has been intensifying for years. This makes it all the more important to recover secondary raw materials from the recycling of used traction batteries.

The EU has already launched key initiatives to close gaps in Europe’s raw material supply. Of particular importance are efforts to build a European battery and recycling industry — for instance through recycling targets for batteries placed on the European market (Battery Regulation), supply targets for critical raw materials (Critical Raw Materials Act), and the industrial strategy for the automotive sector. Germany is now in the process of aligning its national battery legislation with these European developments, including provisions on the take-back of traction batteries from electric vehicles. Current legislation was never designed for e-mobility. It covers a wide range of product groups — from disposable e-cigarettes to the traction batteries of SUVs.

Yet battery recycling is about far more than waste or environmental policy. Above all, it concerns the strategic supply of raw materials to industry and the economy at large. After all, the traction battery is the core component of electric-mobility value creation. Recycling battery materials strengthens the competitiveness of Germany’s automotive industry, reinforces Europe’s market independence, and contributes directly to climate protection in road transport. Germany can build on decades of experience in recycling. With traction-battery recycling at

industrial scale, there is now an opportunity to establish a new, globally leading high-tech sector for Europe.

Against this background, Agora Verkehrswende — together with the Oeko-Institute and with support from Stiftung GRS Batterien — has examined in this study how value chains and material cycles for lithium-ion batteries in the automotive sector are likely to evolve, and what business models for lithium-ion battery recycling in the EU could look like. Following the EU Battery Regulation adopted in 2023, vehicle manufacturers — as those placing traction batteries on the market — are legally obliged to take back their batteries and to meet recovery rates for lithium, cobalt, and nickel. From 2031, mandatory recycled content targets will also apply for the production of new batteries. To meet these obligations, manufacturers can either organise recycling themselves — potentially through their own recycling facilities — or appoint a producer responsibility organisation to manage it on their behalf.

The challenges are substantial. These investments require long-term planning horizons. If sufficient quantities of battery materials recycled within Europe are to be available by 2040, the groundwork must be laid now. At the same time, ongoing technological change — for example in the chemical composition of traction batteries — will continue to bring new requirements. To address these and other questions effectively, dialogue and cooperation among stakeholders must be further strengthened.

This study represents a first step. It is intended to help inform the decisions now facing policymakers and industry on traction-battery recycling, and to support an ongoing dialogue on the outstanding issues. We look forward to continuing the debate — and wish you an engaging read.

Study funded by the GRS Batteries Foundation.

Key findings

Bibliographical data

Downloads

-

Study

pdf 3 MB

Material Cycles for Traction Batteries

Raw material potential of battery recycling in the automotive industry and options for meeting extended producer responsibility in Europe

All figures in this publication

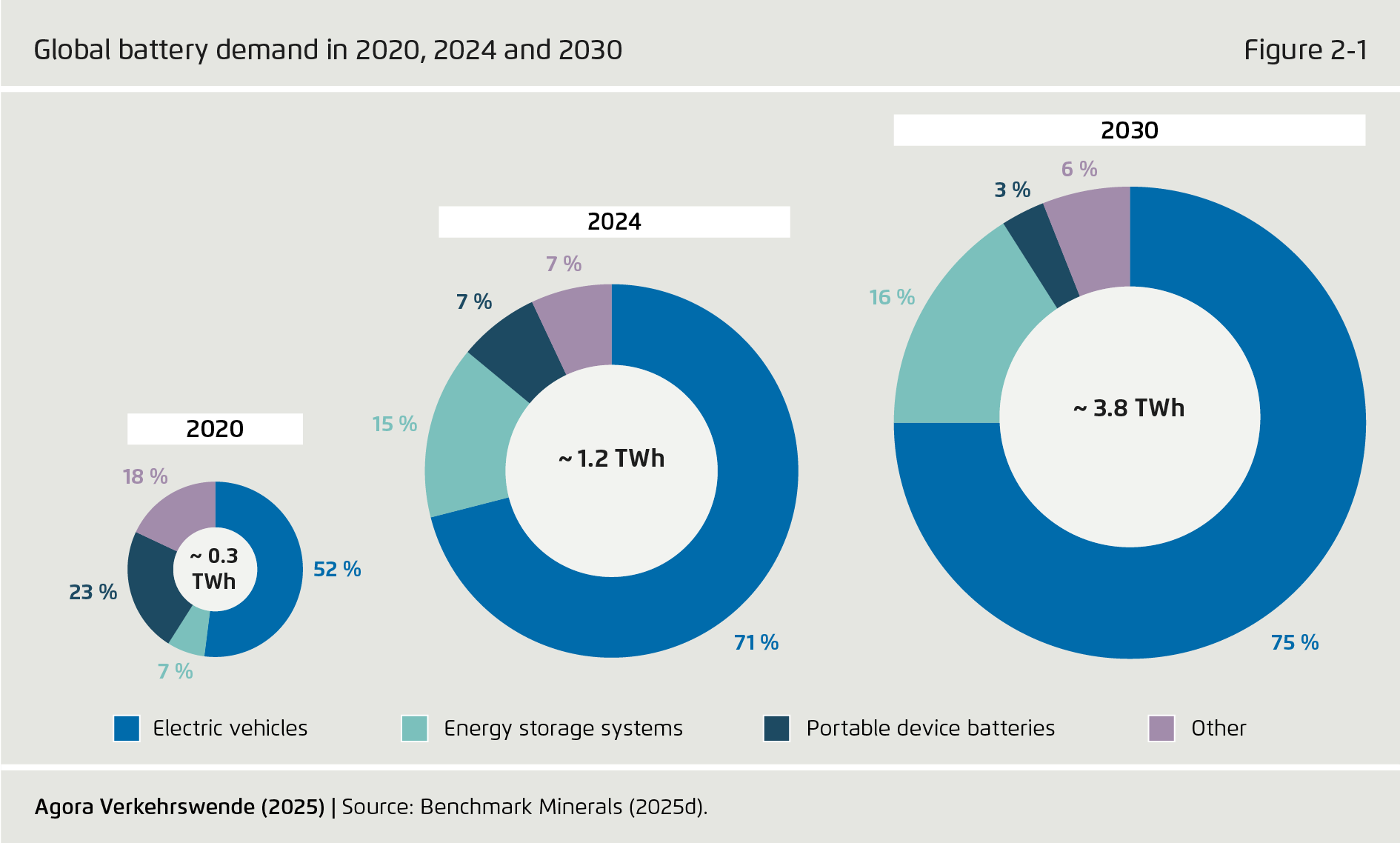

Global battery demand in 2020, 2024 and 2030

Figure 2-1 from Material Cycles for Traction Batteries on page 9

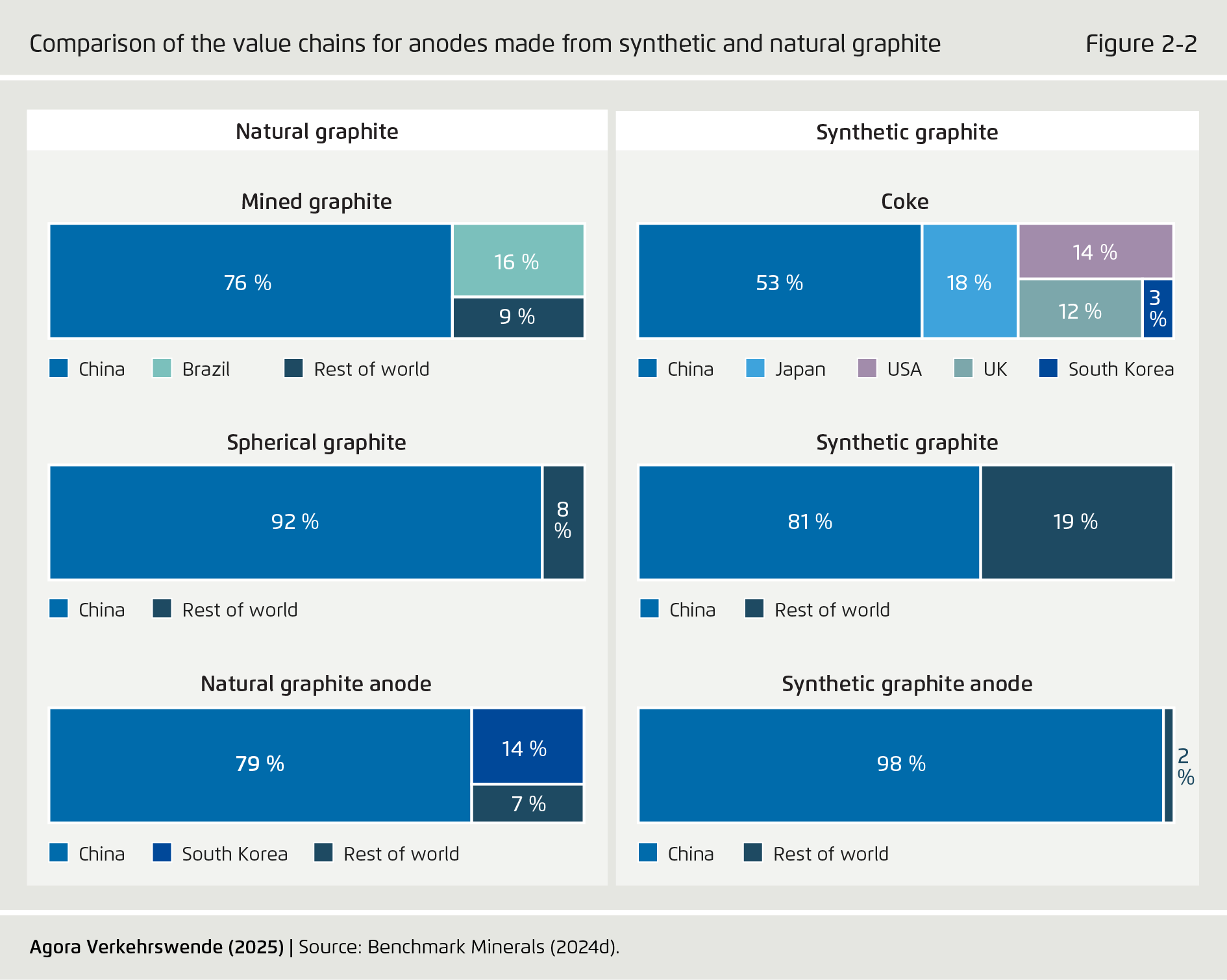

Comparison of the value chains for anodes made from synthetic and natural graphite

Figure 2-2 from Material Cycles for Traction Batteries on page 11